Mastering the Rockefeller Habits: A Comprehensive Plan

Unlocking exponential growth requires a systematic approach; this guide details proven strategies for businesses seeking sustained success and remarkable profitability.

The Rockefeller Habits aren’t about replicating the monopolistic practices of the past, but rather, distilling the core principles that drove John D. Rockefeller’s unprecedented success at Standard Oil. This system, meticulously studied and refined, focuses on creating a highly disciplined and efficient organization capable of sustained, scalable growth.

Verne Harnish, recognizing the enduring power of these principles, formalized them into a practical framework for modern businesses. He observed that Rockefeller’s companies weren’t built on brilliant innovation alone, but on a relentless focus on a few key metrics and a commitment to rigorous execution.

At its heart, the Rockefeller Habits emphasize simplicity and focus. By identifying your core economic engine and concentrating resources on a limited number of priorities, you can dramatically improve performance and achieve remarkable results. This introduction sets the stage for understanding how to implement these powerful habits within your own organization.

A. The Legacy of John D. Rockefeller

John D. Rockefeller’s story is often framed by the immense wealth he accumulated, but his true legacy lies in the organizational innovations he pioneered at Standard Oil. He didn’t simply stumble into success; he built a system – a remarkably efficient and data-driven machine – that dominated its industry for decades.

Rockefeller understood the power of centralization, standardization, and control. He meticulously tracked key performance indicators, demanded accountability from his team, and fostered a culture of continuous improvement. This wasn’t about micromanagement, but about ensuring everyone was aligned and focused on the same critical objectives.

His approach wasn’t without controversy, but the underlying principles of disciplined execution, data-driven decision-making, and a relentless pursuit of efficiency remain profoundly relevant for businesses today. Studying Rockefeller’s methods provides invaluable insights into building a truly scalable and sustainable enterprise.

B. Verne Harnish and the Origins of the System

Verne Harnish, a renowned growth strategist and author, didn’t invent the principles behind the Rockefeller Habits; he rediscovered and codified them. While working with family businesses in the 1990s, Harnish noticed striking similarities in the practices of consistently successful companies – practices that mirrored those employed by John D. Rockefeller and his team at Standard Oil.

Harnish realized these weren’t accidental occurrences, but rather a deliberate system for scaling businesses. He meticulously documented these habits, refining them into a practical framework accessible to entrepreneurs and leaders of all sizes.

His book, Mastering the Rockefeller Habits, became a cornerstone for growth-oriented companies, offering a blueprint for achieving predictable and sustainable success. Harnish’s contribution wasn’t just in identifying the habits, but in making them actionable and adaptable for the modern business landscape.

C. Core Principles: Simplicity & Focus

At the heart of the Rockefeller Habits lie two fundamental principles: radical simplicity and unwavering focus. Rockefeller understood that complexity breeds inefficiency and that spreading resources too thin diminishes impact. His approach prioritized identifying the vital few key performance indicators (KPIs) that truly drove the business forward, ignoring everything else.

This isn’t about doing less; it’s about doing the right things, exceptionally well. Simplicity extends to decision-making processes, communication, and organizational structure.

By streamlining operations and concentrating efforts on a limited number of strategic priorities, companies can achieve greater clarity, alignment, and ultimately, faster growth. Focus isn’t merely a tactic; it’s a cultural imperative.

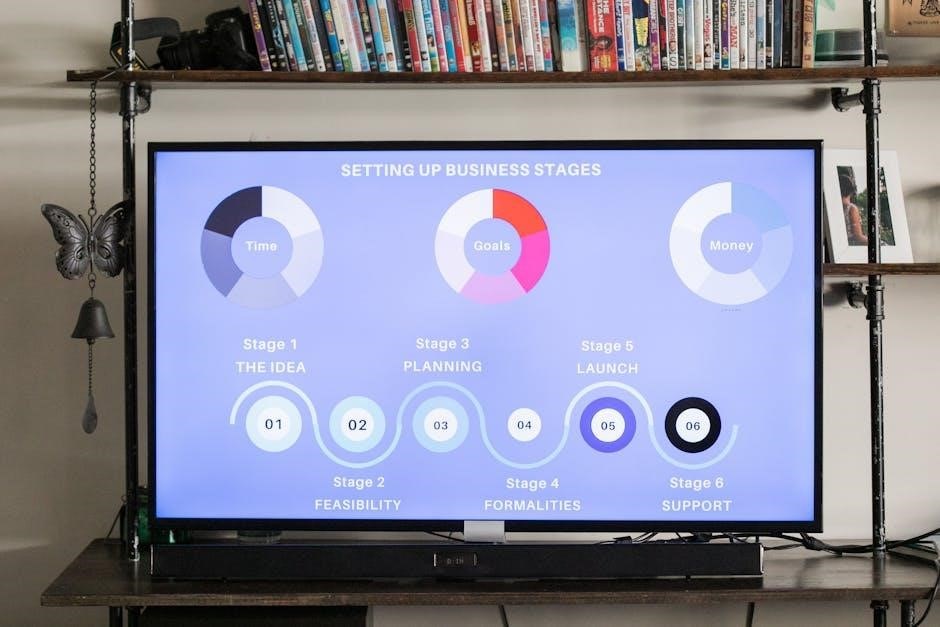

II. The Four Decision Categories

Effective leadership hinges on discerning the appropriate level of involvement for different types of decisions. Verne Harnish categorized decisions into four distinct levels, each demanding a unique approach and time commitment. This framework prevents leaders from getting bogged down in trivial matters while ensuring critical issues receive adequate attention.

These categories aren’t about delegating everything; they’re about strategically allocating your time and energy. Understanding where each decision falls allows for the creation of clear protocols and empowers teams to operate with greater autonomy.

Proper categorization fosters efficiency, reduces bottlenecks, and ultimately, accelerates the pace of growth. Mastering this system is paramount to scaling a business effectively.

A. Daily Decisions (Run the Business)

Daily decisions represent the operational heartbeat of your organization – the tasks and choices required to keep things functioning smoothly. These are typically routine, predictable, and should be handled by empowered employees without requiring leadership intervention. Think of order fulfillment, customer service inquiries, or basic inventory management.

The goal isn’t to eliminate these decisions, but to systemize them. Standard Operating Procedures (SOPs) are crucial here, providing clear guidelines and minimizing ambiguity. A well-defined process allows team members to resolve issues independently, freeing up leadership to focus on higher-level strategic initiatives;

Effective daily operations are the foundation upon which growth is built; neglecting them creates instability.

B. Weekly Decisions (Manage the Business)

Weekly decisions focus on managing the business, ensuring it’s on track to meet quarterly and annual objectives. This level involves reviewing key performance indicators (KPIs), addressing immediate challenges, and making adjustments to maintain momentum. These decisions typically require a team meeting – the Level 10 Meeting – to foster transparency and accountability.

Topics include sales pipeline review, marketing campaign performance, and a quick assessment of operational bottlenecks. The emphasis is on identifying issues early before they escalate into larger problems. Weekly decisions are about course correction, not crisis management.

Consistent weekly reviews provide a rhythm for proactive management, preventing surprises and driving continuous improvement.

C. Quarterly Decisions (Strategize the Business)

Quarterly decisions are dedicated to strategizing the business, setting priorities, and charting the course for the next 90 days. This is where the leadership team steps back from daily operations to focus on the bigger picture, analyzing market trends and competitive landscapes.

The Quarterly Coherence Meeting is crucial, involving identifying 1-3 key priorities that will have the most significant impact. These priorities are not simply tasks; they are strategic initiatives designed to move the company closer to its 10-year target.

Resource allocation, potential risks, and clear ownership are defined during this phase, ensuring focused execution.

D. Annual Decisions (Transform the Business)

Annual decisions represent the highest level of strategic thinking, focused on fundamentally transforming the business for long-term success. This isn’t about incremental improvements; it’s about identifying opportunities for significant leaps forward, potentially reshaping the company’s core offerings or market position.

These decisions often involve substantial investments in research and development, new market entry, or major organizational changes. The 10-Year Target serves as the guiding star, ensuring annual initiatives align with the overarching vision.

Risk assessment is paramount, alongside a clear articulation of the desired future state and the resources required to achieve it.

III. The Rockefeller Habits – Key Components

Several interconnected components form the bedrock of the Rockefeller Habits, working synergistically to drive organizational performance and clarity. First, pinpointing your Economic Engine – the core process that generates revenue and profit – is crucial for focused effort.

Next, defining Core Values establishes a strong cultural foundation, guiding behavior and decision-making throughout the organization. These aren’t just words on a wall; they’re principles actively lived.

Finally, establishing a compelling 10-Year Target – a “Big, Hairy, Audacious Goal” – provides a long-term vision, inspiring innovation and commitment. These elements, when implemented effectively, create a powerful framework for sustainable growth.

A. Identifying Your Economic Engine

The Economic Engine represents the single, repeatable process that drives the majority of your company’s revenue and profitability. Identifying it isn’t about listing all revenue sources, but pinpointing the core mechanism. Ask: What activity, when executed exceptionally well, consistently delivers the greatest financial return?

This often involves a specific customer segment, product line, or service offering. Focusing on optimizing this engine – improving its efficiency, scalability, and customer experience – yields disproportionate results.

Don’t confuse revenue streams with the engine itself; the engine generates those streams. Once identified, relentlessly measure and refine this core process for maximum impact.

B; Core Values – Defining Your Culture

Core Values are the fundamental beliefs that guide your company’s actions, behaviors, and decision-making. They aren’t aspirational statements; they describe how you operate, even when no one is watching. Effective Core Values are few in number – typically 3 to 5 – and deeply ingrained within the organization.

They should be easily remembered and actively used in hiring, performance evaluations, and conflict resolution. Authentic Core Values attract like-minded individuals and repel those who don’t align with your culture.

Don’t simply copy values from other companies; they must genuinely reflect your unique identity and principles. A strong culture, rooted in well-defined Core Values, fosters engagement and drives long-term success.

C. 10-Year Target – The Big, Hairy, Audacious Goal

The 10-Year Target is a long-term, ambitious goal that stretches the organization and inspires extraordinary effort. It’s not a prediction, but a compelling vision of what the company could achieve if everything goes right. This “BHAG” (Big, Hairy, Audacious Goal) should be qualitative, not merely quantitative, and emotionally resonant with the team.

It serves as a North Star, guiding strategic decisions and fostering a sense of shared purpose. Developing a 10-Year Target requires bold thinking and a willingness to challenge conventional wisdom.

Regularly revisiting and refining this target keeps the organization focused on long-term value creation and prevents complacency. It’s about dreaming big and then systematically working towards that dream.

IV. Implementing the Rockefeller Habits – Practical Steps

Successfully adopting the Rockefeller Habits requires a structured implementation process, starting with commitment from leadership. Begin by establishing a clear understanding of the four decision categories and their respective frequencies. Prioritize the implementation of the Weekly Level 10 Meeting as the cornerstone of the system, ensuring consistent adherence to the agenda and focus on key metrics.

Next, schedule and facilitate the Quarterly Coherence Meeting to align on priorities and address critical issues. Regularly review and refine the scorecard, ensuring it accurately reflects the company’s economic engine.

Remember, consistent execution and disciplined follow-through are paramount for realizing the benefits of these habits.

A. The Weekly Level 10 Meeting

The Weekly Level 10 Meeting is the engine driving accountability and progress within the Rockefeller Habits framework. This 90-minute meeting, held religiously every week, focuses on reviewing key metrics from the scorecard and identifying any issues preventing the company from achieving its quarterly priorities. It’s not a status update, but a problem-solving session.

Each attendee must come prepared to report on their rocks (top priorities) and discuss any roadblocks encountered. The meeting concludes with a clear action list and assigned owners, ensuring follow-through.

Maintaining a Level 10 discipline – meaning issues are addressed immediately – is crucial for sustained momentum.

Agenda & Structure

A tightly structured agenda is paramount for an effective Level 10 Meeting. Begin with a quick review of the scorecard – 5 minutes max – focusing on red flags. Next, dedicate time to each team member’s rocks, allowing 10-15 minutes per person to discuss progress, obstacles, and required support.

Crucially, dedicate time to “Issues List” items – problems identified in previous meetings – ensuring accountability for resolution.

Conclude with a clear action item list, assigning owners and deadlines. The agenda should be consistent week after week, fostering predictability and efficiency. Sticking to the time limits is vital; a timekeeper is recommended.

Key Metrics & Scorecard

The Scorecard is the heart of the Level 10 Meeting, displaying 5-7 key metrics that directly impact your economic engine. These aren’t vanity metrics; they must be measurable, actionable, and consistently tracked. Include both leading and lagging indicators – leading indicators predict future performance, while lagging indicators report on past results;

Metrics should be reviewed weekly, identifying trends and deviations from targets. Red flags signal areas needing immediate attention. The scorecard fosters transparency and accountability, forcing focus on what truly matters.

Regularly revisit and refine your metrics as your business evolves, ensuring they remain relevant and impactful.

B. The Quarterly Coherence Meeting

The Quarterly Coherence Meeting is a dedicated, off-site session – typically a full day – focused on strategic alignment and future planning. It’s where the leadership team steps away from daily operations to assess progress, identify challenges, and chart the course for the next 90 days.

This meeting isn’t about problem-solving; it’s about proactively identifying potential issues and opportunities. The goal is to ensure everyone is rowing in the same direction, with a clear understanding of priorities and expectations.

Preparation is key – pre-reading materials and individual reflection are essential for a productive session.

Setting Quarterly Priorities

During the Quarterly Coherence Meeting, identifying 3-5 key priorities is paramount. These aren’t simply tasks; they are the critical initiatives that will drive the most significant impact on the business’s economic engine. Focus is crucial; spreading resources too thin diminishes effectiveness.

Priorities should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). Each priority needs a clear owner responsible for driving it to completion. Regular progress updates during the weekly Level 10 meetings ensure accountability.

Resist the urge to overload the quarter. Fewer, well-executed priorities yield better results than a long list of partially completed projects.

Identifying Issues & Opportunities

A core function of the Quarterly Coherence Meeting is a candid assessment of the past quarter and a proactive look ahead. This involves openly discussing what worked, what didn’t, and why. Encourage honest feedback – a psychologically safe environment is essential for surfacing critical issues.

Brainstorm potential opportunities for growth and improvement. Consider market trends, competitor actions, and internal capabilities. Don’t limit thinking to incremental changes; explore disruptive possibilities.

Document all identified issues and opportunities, assigning ownership for further investigation and resolution. This list forms the basis for action planning in the following quarter.

V; Deep Dive into Key Metrics & Scorecards

Effective scorecards are the lifeblood of the Rockefeller Habits, translating strategy into measurable results. They provide a clear, concise overview of business performance, enabling informed decision-making. Focus on a limited number of key metrics – typically 5-7 – that directly impact your economic engine.

Distinguish between leading and lagging indicators. Lagging indicators report on past performance (e.g., revenue), while leading indicators predict future results (e.g., sales pipeline). Prioritize leading indicators to proactively manage your business;

Regularly track and analyze performance against targets. Identify trends, investigate deviations, and adjust strategies accordingly. A balanced scorecard considers financial, customer, internal process, and learning & growth perspectives.

A. Identifying Leading & Lagging Indicators

Understanding the difference between leading and lagging indicators is crucial for proactive management. Lagging indicators, like revenue and profit, reflect past performance – they tell you what happened. While important for historical analysis, they offer limited predictive power.

Leading indicators, conversely, predict future results. Examples include website traffic, sales pipeline value, customer acquisition cost, and employee satisfaction. These metrics are actionable; improving them directly influences future lagging indicators.

Focus your efforts on influencing leading indicators. By monitoring and optimizing these, you can steer your business towards desired outcomes. A good rule of thumb: for every lagging indicator, identify at least two or three corresponding leading indicators.

B. Creating a Balanced Scorecard

A Balanced Scorecard translates your strategic objectives into a comprehensive set of performance measures. It moves beyond solely financial metrics, encompassing perspectives crucial for long-term success.

Typically, a scorecard includes four key perspectives: Financial (revenue, profitability), Customer (satisfaction, retention), Internal Processes (efficiency, quality), and Learning & Growth (innovation, employee skills).

For each perspective, define 2-3 key metrics. Ensure these metrics are directly linked to your strategic priorities and are measurable. Avoid overwhelming the scorecard – focus on the vital few indicators that truly drive performance. Regularly review and adjust the scorecard as your business evolves.

C. Tracking & Analyzing Performance

Consistent tracking of your scorecard metrics is paramount. Implement a system – whether a spreadsheet, dashboard, or specialized software – to regularly collect and visualize data. Frequency matters; weekly reviews during Level 10 meetings are ideal.

Analysis goes beyond simply observing numbers. Investigate why performance is trending up or down. Identify root causes, not just symptoms. Look for correlations between different metrics – are improvements in employee training leading to higher customer satisfaction?

Use data to inform decisions. Adjust strategies, allocate resources, and address bottlenecks based on performance insights. Don’t be afraid to pivot if the data indicates a change in course is needed.

VI. Advanced Rockefeller Habits Techniques

Beyond the basics, several techniques refine the Rockefeller Habits implementation. The “Danger Zone” identifies critical issues threatening quarterly priorities – address these immediately with dedicated action plans. Proactive problem-solving prevents minor concerns from escalating.

The “People Analyzer” objectively assesses team member performance, focusing on contributions to key metrics and alignment with core values. This isn’t about blame, but about identifying development opportunities and ensuring the right people are in the right roles.

Understanding “Rockefellers vs. Mavericks” reveals team dynamics. Rockefellers thrive on structure, while Mavericks excel with autonomy. Leverage both for optimal innovation and execution.

A. The Danger Zone – Identifying Critical Issues

The Danger Zone represents issues jeopardizing quarterly priorities; immediate attention is crucial. During Level 10 Meetings, dedicate specific time to openly discuss these threats – no sugarcoating allowed! Honest assessment is paramount.

Categorize issues by severity and impact. High-priority dangers demand immediate action plans with assigned owners and deadlines. Lower-priority items can be parked for later, but shouldn’t be ignored entirely.

Effective Danger Zone management involves root cause analysis – don’t just treat symptoms. Dig deeper to understand the underlying problems. Document all issues and action plans for accountability and tracking. Regular review ensures progress and prevents recurrence.

B. People Analyzer – Assessing Team Performance

The People Analyzer is a vital tool for evaluating team member contributions and identifying performance gaps. It’s not about blame, but about fostering growth and maximizing potential. Categorize employees based on performance and engagement – Stars, Solid Citizens, and Problem Players.

Stars consistently exceed expectations and inspire others. Solid Citizens are reliable and contribute consistently. Problem Players consistently underperform or disrupt the team. Honest assessment is key, based on objective data, not personal feelings.

Develop tailored plans for each category. Stars deserve recognition and opportunities for advancement. Solid Citizens need continued support and development. Problem Players require direct feedback, performance improvement plans, or, if necessary, separation. Regular review is essential.

C. Rockefellers vs. Mavericks – Understanding Team Dynamics

Recognizing differing work styles is crucial for team cohesion. The Rockefeller Habits identify two primary personality types: Rockefellers and Mavericks. Rockefellers thrive in structured environments, valuing process, predictability, and detailed planning. They excel at execution and maintaining order.

Mavericks, conversely, are innovative, independent thinkers who prefer autonomy and dislike rigid rules. They’re idea generators and comfortable with ambiguity. Neither type is inherently better; both are valuable.

Effective teams leverage both strengths. Assign Rockefellers to roles requiring meticulous execution and process management. Empower Mavericks with creative tasks and strategic initiatives. Understanding these differences minimizes conflict and maximizes productivity. Facilitate communication and mutual respect to harness the power of diverse perspectives.

VII. Sustaining the Rockefeller Habits Long-Term

Long-term success demands consistent application and adaptation. The Rockefeller Habits aren’t a one-time fix, but an ongoing commitment to improvement. Continuous improvement requires regularly revisiting core values, metrics, and processes, ensuring they remain relevant and effective as the business evolves.

Building accountability is paramount. Clearly defined roles, responsibilities, and measurable goals empower team members to take ownership. Foster a culture where constructive feedback is welcomed and performance is transparently tracked.

Leadership commitment is the cornerstone of sustainability. Leaders must champion the habits, actively participate in meetings, and model the desired behaviors. Without unwavering support from the top, the system will inevitably falter. Prioritize consistent reinforcement and celebrate successes to embed the habits into the organizational DNA.

A. Continuous Improvement & Adaptation

The business landscape is dynamic; stagnation equals decline. Continuous improvement isn’t about fixing problems, but proactively seeking better ways to operate. Regularly review your Economic Engine and 10-Year Target – are they still accurate and inspiring? Adapt your strategies based on market changes and performance data.

Embrace experimentation. Encourage teams to test new ideas, even if they fail. Failure provides valuable learning opportunities. Regularly revisit your Core Values; do they still reflect your company’s identity and guide decision-making?

Refine your metrics. Are your Key Metrics still the most relevant indicators of success? Adjust them as needed to ensure they accurately reflect your progress. A commitment to ongoing refinement ensures the Rockefeller Habits remain a powerful engine for growth.

B. Building Accountability & Ownership

Accountability isn’t about blame; it’s about responsibility. Clearly define roles and expectations for each team member, linking them directly to Key Metrics and Quarterly Priorities. Ensure everyone understands what they are accountable for and how their performance will be measured.

Foster ownership. Empower employees to take initiative and make decisions within their areas of responsibility. Encourage them to identify and solve problems independently. The Weekly Level 10 Meeting is crucial for reviewing progress and addressing roadblocks.

Celebrate successes and address shortcomings constructively. Recognize and reward individuals who demonstrate accountability and ownership. When issues arise, focus on learning and improvement, not punishment. A culture of accountability drives results.

C. The Importance of Leadership Commitment

The Rockefeller Habits won’t flourish without unwavering leadership support. Leaders must champion the system, actively participate in meetings – especially the Level 10 and Coherence Meetings – and consistently model the desired behaviors. This isn’t delegation; it’s leading by example.

Commitment means allocating time and resources. Prioritize the implementation of the habits, even when faced with competing demands. Invest in training and development to ensure the team understands and embraces the methodology.

Leaders must hold themselves and others accountable. Regularly review the Scorecard, ask tough questions, and drive continuous improvement. A committed leadership team creates a culture of discipline and focus, essential for long-term success.