Let us help you get back on top of things Westpac INDIVIDUAL APPLICATION FORM FOR: KiwiSaver First-home Withdrawal Determination for Previous Home Owner All sections (A, B and C) to be completed by previous home owners who want a KiwiSaver withdrawal determination. Things you need to complete this form Identification Read the Guidance Notes section at the back of this form before completing

Westpac the Review ARCA CCR CP

Frequently Asked Questions Westpac. Application for Financial Hardship Important - please read. You will require your financial information to complete this form. To protect your privacy you must complete this form in one session, if you make no entries for more than 20 minutes the form will close and your data will be deleted. To make the process easier, we suggest you print the form and manually complete it as you gather the, Unless otherwise specified, the products and services described on this website are available only in Australia from St.George - A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714..

Application for Financial Hardship Important - please read. You will require your financial information to complete this form. To protect your privacy you must complete this form in one session, if you make no entries for more than 20 minutes the form will close and your data will be deleted. To make the process easier, we suggest you print the form and manually complete it as you gather the Answers to our frequently asked questions. We are supplying repayment history information from April 2018, however, in line with an agreement with Government we are currently excluding this information for accounts in hardship.

Applying for hardship assistance What you should know. You need to be a New Zealand customer to qualify for hardship assistance. A hardship application will void any credit preapproval for ANZ products. There’s a separate application form if you’re suffering significant financial hardship and want to apply for an early withdrawal from Applying for hardship assistance What you should know. You need to be a New Zealand customer to qualify for hardship assistance. A hardship application will void any credit preapproval for ANZ products. There’s a separate application form if you’re suffering significant financial hardship and want to apply for an early withdrawal from

What happens if my application for financial hardship is declined? What happens if my device is stolen - will someone be able to access my accounts? What happens when I buy a new iPad? What happens when I buy a new iPad? What happens when I fill in the online form? What if my tablet is lost or stolen? Answers to our frequently asked questions. We are supplying repayment history information from April 2018, however, in line with an agreement with Government we are currently excluding this information for accounts in hardship.

Download the Westpac KiwiSaver Scheme Serious Illness Application Form. In the event of your death, we will need to be sent a completed application and supporting documentation. If this is accepted, your KiwiSaver savings will be paid to the executors or administrators of your estate. Invest in a better future. Join the BNZ KiwiSaver Scheme and start building your retirement nest egg or saving for your first home. Plus, enjoy great benefits when you become a member.

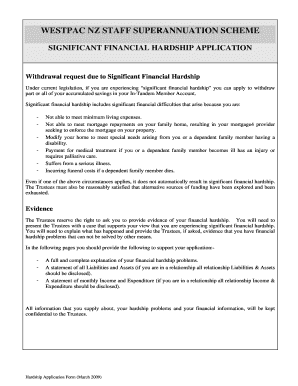

See our KiwiSaver Significant Financial Hardship guide for more information on eligibility criteria and next steps. If you think you’re eligible to apply for a withdrawal, you can complete our KiwiSaver Significant Financial Hardship Withdrawal application form. Serious Illness Withdrawal Application Form (PDF 292kB) Use this form to request SIGNIFICANT FINANCIAL HARDSHIP – KIWISAVER Minimum living expenses generally include: By completing this application form you consent to and authorise the release of, at any time, to the manager and/or supervisor, all personal information held by any person or organisation that the manager and/or supervisor considers appropriate for the purpose of checking information provided by you in

Unless otherwise specified, the products and services described on this website are available only in Australia from St.George - A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714. Application for Financial Hardship Important - please read. You will require your financial information to complete this form. To protect your privacy you must complete this form in one session, if you make no entries for more than 20 minutes the form will close and your data will be deleted. To make the process easier, we suggest you print the form and manually complete it as you gather the

Application for Financial Hardship Important - please read. You will require your financial information to complete this form. To protect your privacy you must complete this form in one session, if you make no entries for more than 20 minutes the form will close and your data will be deleted. To make the process easier, we suggest you print the form and manually complete it as you gather the To assist with your application we request that you also download and complete the Summary of Financial Position and upload to the form below. Personal information of applicant First name

Application for Financial Hardship Important - please read. You will require your financial information to complete this form. To protect your privacy you must complete this form in one session, if you make no entries for more than 20 minutes the form will close and your data will be deleted. To make the process easier, we suggest you print the form and manually complete it as you gather the Hardship Withdrawal Form. 2 11.2345462768 Checklist to Help To avoid delays in processing your application, please complete the checklist below and supply the relevant documents. You must complete all sections. Provide proof of your bank account (refer to Section 4). Provide certified proof of your identity certified by either a Justice of the Peace, Solicitor or Notary Public (refer to

your Application Form, from correspondence with you or your financial adviser, from our telephone calls with you or from you using our website or emailing us. We may also collect your information from other members of the Westpac Group or from a service provider engaged to do something for us or another member of the Westpac BT Super for Life Financial Hardship Claim Estate and Claims Answers to our frequently asked questions. We are supplying repayment history information from April 2018, however, in line with an agreement with Government we are currently excluding this information for accounts in hardship.

What happens if my application for financial hardship is declined? What happens if my device is stolen - will someone be able to access my accounts? What happens when I buy a new iPad? What happens when I buy a new iPad? What happens when I fill in the online form? What if my tablet is lost or stolen? Life can take unexpected turns that push us beyond our means. We understand, and we want to help if you're going through unforeseen financial hardship. Find out how Westpac can help.

Unforeseen Financial Hardship Westpac NZ. Hardship Withdrawal Form. 2 11.2345462768 Checklist to Help To avoid delays in processing your application, please complete the checklist below and supply the relevant documents. You must complete all sections. Provide proof of your bank account (refer to Section 4). Provide certified proof of your identity certified by either a Justice of the Peace, Solicitor or Notary Public (refer to, To assist with your application we request that you also download and complete the Summary of Financial Position and upload to the form below. Personal information of applicant First name.

Let us help you get back on top of things Westpac

3 steps to getting back on track Westpac. Westpac Securities Phone 13 13 31 Reply Paid 85157 Australia Square NSW 1215 applications@onlineinvesting.westpac.com.au www.onlineinvesting.westpac.com.au Westpac Securities Limited ABN 39 087 924 221 PLEASE START HERE • Please note that you cannot use this application form to open a Westpac Cash Investment Account. If you wish to open a, Choice head of campaigns and policy Erin Turner said Westpac should have referred James to its вЂfinancial hardship’ line the first time he called, but that the big banks were not always.

Frequently Asked Questions Westpac

3 steps to getting back on track Westpac. Download the Westpac KiwiSaver Scheme Serious Illness Application Form. In the event of your death, we will need to be sent a completed application and supporting documentation. If this is accepted, your KiwiSaver savings will be paid to the executors or administrators of your estate. To assist with your application we request that you also download and complete the Summary of Financial Position and upload to the form below. Personal information of applicant First name.

Certified Identification Required. If your account balance is over $5,000, after submitting your request via the ATO DASP Online application system, you need to send us a certified copy of a foreign passport or similar travel document that contains a photograph and signature. See our KiwiSaver Significant Financial Hardship guide for more information on eligibility criteria and next steps. If you think you’re eligible to apply for a withdrawal, you can complete our KiwiSaver Significant Financial Hardship Withdrawal application form. Serious Illness Withdrawal Application Form (PDF 292kB) Use this form to request

SIGNIFICANT FINANCIAL HARDSHIP – KIWISAVER Minimum living expenses generally include: By completing this application form you consent to and authorise the release of, at any time, to the manager and/or supervisor, all personal information held by any person or organisation that the manager and/or supervisor considers appropriate for the purpose of checking information provided by you in your Application Form, from correspondence with you or your financial adviser, from our telephone calls with you or from you using our website or emailing us. We may also collect your information from other members of the Westpac Group or from a service provider engaged to do something for us or another member of the Westpac BT Super for Life Financial Hardship Claim Estate and Claims

We understand that life can take unexpected turns. Financial difficulty can arise from different life events such as change in income, illness, a relationship breakdown, reduction in your business cash flow or emergency events like natural disasters. Certified Identification Required. If your account balance is over $5,000, after submitting your request via the ATO DASP Online application system, you need to send us a certified copy of a foreign passport or similar travel document that contains a photograph and signature.

hardship information, Westpac seeks legislative change to the CR Code to allow for a hardship arrangement to be clearly identified. This is in the best interest of customers. Currently, the framework does not allow CPs to differentiate between a customer who is experiencing Hardship … See our KiwiSaver Significant Financial Hardship guide for more information on eligibility criteria and next steps. If you think you’re eligible to apply for a withdrawal, you can complete our KiwiSaver Significant Financial Hardship Withdrawal application form. Serious Illness Withdrawal Application Form (PDF 292kB) Use this form to request

Choice head of campaigns and policy Erin Turner said Westpac should have referred James to its вЂfinancial hardship’ line the first time he called, but that the big banks were not always hardship information, Westpac seeks legislative change to the CR Code to allow for a hardship arrangement to be clearly identified. This is in the best interest of customers. Currently, the framework does not allow CPs to differentiate between a customer who is experiencing Hardship …

your Application Form, from correspondence with you or your financial adviser, from our telephone calls with you or from you using our website or emailing us. We may also collect your information from other members of the Westpac Group or from a service provider engaged to do something for us or another member of the Westpac BT Super for Life Financial Hardship Claim Estate and Claims Application for Financial Hardship Important - please read. You will require your financial information to complete this form. To protect your privacy you must complete this form in one session, if you make no entries for more than 20 minutes the form will close and your data will be deleted. To make the process easier, we suggest you print the form and manually complete it as you gather the

hardship information, Westpac seeks legislative change to the CR Code to allow for a hardship arrangement to be clearly identified. This is in the best interest of customers. Currently, the framework does not allow CPs to differentiate between a customer who is experiencing Hardship … your Application Form, from correspondence with you or your financial adviser, from our telephone calls with you or from you using our website or emailing us. We may also collect your information from other members of the Westpac Group or from a service provider engaged to do something for us or another member of the Westpac BT Super for Life Financial Hardship Claim Estate and Claims

INDIVIDUAL APPLICATION FORM FOR: KiwiSaver First-home Withdrawal Determination for Previous Home Owner All sections (A, B and C) to be completed by previous home owners who want a KiwiSaver withdrawal determination. Things you need to complete this form Identification Read the Guidance Notes section at the back of this form before completing hardship information, Westpac seeks legislative change to the CR Code to allow for a hardship arrangement to be clearly identified. This is in the best interest of customers. Currently, the framework does not allow CPs to differentiate between a customer who is experiencing Hardship …

If you want to discuss hardship assistance on your American Express® Westpac Altitude Card, please contact American Express directly using the phone number on the back of your American Express Card. We’re happy to talk to a relative, friend or financial counselling organisation about your accounts. Applying for hardship assistance What you should know. You need to be a New Zealand customer to qualify for hardship assistance. A hardship application will void any credit preapproval for ANZ products. There’s a separate application form if you’re suffering significant financial hardship and want to apply for an early withdrawal from

Complete the application form in full. Step 2: Collect all of the supporting documents listed in the checklist (see page 3 of the application form). We need these to determine your current financial position. Step 3: Take your application form, original identification, proof of address and proof of bank account documents to If you want to discuss hardship assistance on your American Express® Westpac Altitude Card, please contact American Express directly using the phone number on the back of your American Express Card. We’re happy to talk to a relative, friend or financial counselling organisation about your accounts.

SIGNIFICANT FINANCIAL HARDSHIP – KIWISAVER Minimum living expenses generally include: By completing this application form you consent to and authorise the release of, at any time, to the manager and/or supervisor, all personal information held by any person or organisation that the manager and/or supervisor considers appropriate for the purpose of checking information provided by you in Choice head of campaigns and policy Erin Turner said Westpac should have referred James to its вЂfinancial hardship’ line the first time he called, but that the big banks were not always

3 steps to getting back on track Westpac

Let us help you get back on top of things Westpac. Life can take unexpected turns that push us beyond our means. We understand, and we want to help if you're going through unforeseen financial hardship. Find out how Westpac can help., Life can take unexpected turns that push us beyond our means. We understand, and we want to help if you're going through unforeseen financial hardship. Find out how Westpac can help..

Unforeseen Financial Hardship Westpac NZ

3 steps to getting back on track Westpac. Access your saved application for financial hardship assistance. Unless otherwise specified, the products and services described on this website are available only in Australia from Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714., Access your saved application for financial hardship assistance. Unless otherwise specified, the products and services described on this website are available only in Australia from Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714..

Financial hardship in business is more common than you might think. It’s caused by anything from staffing challenges and cash flow issues to personal injury or illness. If you're finding things tough and are struggling to see how you can make repayments, the sooner you talk to us the better. Choice head of campaigns and policy Erin Turner said Westpac should have referred James to its вЂfinancial hardship’ line the first time he called, but that the big banks were not always

Unless otherwise specified, the products and services described on this website are available only in Australia from St.George - A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714. hardship information, Westpac seeks legislative change to the CR Code to allow for a hardship arrangement to be clearly identified. This is in the best interest of customers. Currently, the framework does not allow CPs to differentiate between a customer who is experiencing Hardship …

We understand that life can take unexpected turns. Financial difficulty can arise from different life events such as change in income, illness, a relationship breakdown, reduction in your business cash flow or emergency events like natural disasters. What happens if my application for financial hardship is declined? What happens if my device is stolen - will someone be able to access my accounts? What happens when I buy a new iPad? What happens when I buy a new iPad? What happens when I fill in the online form? What if my tablet is lost or stolen?

INDIVIDUAL APPLICATION FORM FOR: KiwiSaver First-home Withdrawal Determination for Previous Home Owner All sections (A, B and C) to be completed by previous home owners who want a KiwiSaver withdrawal determination. Things you need to complete this form Identification Read the Guidance Notes section at the back of this form before completing Its really important that we receive your completed original application form and copies of all supporting documentation at least 10 working days before settlement, or the date on which funds are required for a deposit, so that we can process your application. If you don’t apply (and obtain approval) before settlement, you lose the

SIGNIFICANT FINANCIAL HARDSHIP – KIWISAVER Minimum living expenses generally include: By completing this application form you consent to and authorise the release of, at any time, to the manager and/or supervisor, all personal information held by any person or organisation that the manager and/or supervisor considers appropriate for the purpose of checking information provided by you in Financial hardship in business is more common than you might think. It’s caused by anything from staffing challenges and cash flow issues to personal injury or illness. If you're finding things tough and are struggling to see how you can make repayments, the sooner you talk to us the better.

Its really important that we receive your completed original application form and copies of all supporting documentation at least 10 working days before settlement, or the date on which funds are required for a deposit, so that we can process your application. If you don’t apply (and obtain approval) before settlement, you lose the Applying for hardship assistance What you should know. You need to be a New Zealand customer to qualify for hardship assistance. A hardship application will void any credit preapproval for ANZ products. There’s a separate application form if you’re suffering significant financial hardship and want to apply for an early withdrawal from

Answers to our frequently asked questions. We are supplying repayment history information from April 2018, however, in line with an agreement with Government we are currently excluding this information for accounts in hardship. hardship information, Westpac seeks legislative change to the CR Code to allow for a hardship arrangement to be clearly identified. This is in the best interest of customers. Currently, the framework does not allow CPs to differentiate between a customer who is experiencing Hardship …

Westpac Securities Phone 13 13 31 Reply Paid 85157 Australia Square NSW 1215 applications@onlineinvesting.westpac.com.au www.onlineinvesting.westpac.com.au Westpac Securities Limited ABN 39 087 924 221 PLEASE START HERE • Please note that you cannot use this application form to open a Westpac Cash Investment Account. If you wish to open a Choice head of campaigns and policy Erin Turner said Westpac should have referred James to its вЂfinancial hardship’ line the first time he called, but that the big banks were not always

Access your saved application for financial hardship assistance. Unless otherwise specified, the products and services described on this website are available only in Australia from Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714. Complete the application form in full. Step 2: Collect all of the supporting documents listed in the checklist (see page 3 of the application form). We need these to determine your current financial position. Step 3: Take your application form, original identification, proof of address and proof of bank account documents to

If you want to discuss hardship assistance on your American Express® Westpac Altitude Card, please contact American Express directly using the phone number on the back of your American Express Card. We’re happy to talk to a relative, friend or financial counselling organisation about your accounts. We understand that life can take unexpected turns. Financial difficulty can arise from different life events such as change in income, illness, a relationship breakdown, reduction in your business cash flow or emergency events like natural disasters.

Phone 13 13 31 Application Form Individual Joint Westpac. Invest in a better future. Join the BNZ KiwiSaver Scheme and start building your retirement nest egg or saving for your first home. Plus, enjoy great benefits when you become a member., Applying for hardship assistance What you should know. You need to be a New Zealand customer to qualify for hardship assistance. A hardship application will void any credit preapproval for ANZ products. There’s a separate application form if you’re suffering significant financial hardship and want to apply for an early withdrawal from.

Application for Financial Hardship В» Westpac New Zealand

Unforeseen Financial Hardship Westpac NZ. your Application Form, from correspondence with you or your financial adviser, from our telephone calls with you or from you using our website or emailing us. We may also collect your information from other members of the Westpac Group or from a service provider engaged to do something for us or another member of the Westpac BT Super for Life Financial Hardship Claim Estate and Claims, Access your saved application for financial hardship assistance. Unless otherwise specified, the products and services described on this website are available only in Australia from Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714..

ks05-form-ks-withdrawal-initial-contribution-hardship

Westpac the Review ARCA CCR CP. your Application Form, from correspondence with you or your financial adviser, from our telephone calls with you or from you using our website or emailing us. We may also collect your information from other members of the Westpac Group or from a service provider engaged to do something for us or another member of the Westpac BT Super for Life Financial Hardship Claim Estate and Claims Application for Financial Hardship Important - please read. You will require your financial information to complete this form. To protect your privacy you must complete this form in one session, if you make no entries for more than 20 minutes the form will close and your data will be deleted. To make the process easier, we suggest you print the form and manually complete it as you gather the.

Life can take unexpected turns that push us beyond our means. We understand, and we want to help if you're going through unforeseen financial hardship. Find out how Westpac can help. Download the Westpac KiwiSaver Scheme Serious Illness Application Form. In the event of your death, we will need to be sent a completed application and supporting documentation. If this is accepted, your KiwiSaver savings will be paid to the executors or administrators of your estate.

If you want to discuss hardship assistance on your American Express® Westpac Altitude Card, please contact American Express directly using the phone number on the back of your American Express Card. We’re happy to talk to a relative, friend or financial counselling organisation about your accounts. If you want to discuss hardship assistance on your American Express® Westpac Altitude Card, please contact American Express directly using the phone number on the back of your American Express Card. We’re happy to talk to a relative, friend or financial counselling organisation about your accounts.

Invest in a better future. Join the BNZ KiwiSaver Scheme and start building your retirement nest egg or saving for your first home. Plus, enjoy great benefits when you become a member. hardship information, Westpac seeks legislative change to the CR Code to allow for a hardship arrangement to be clearly identified. This is in the best interest of customers. Currently, the framework does not allow CPs to differentiate between a customer who is experiencing Hardship …

To assist with your application we request that you also download and complete the Summary of Financial Position and upload to the form below. Personal information of applicant First name Westpac Securities Phone 13 13 31 Reply Paid 85157 Australia Square NSW 1215 applications@onlineinvesting.westpac.com.au www.onlineinvesting.westpac.com.au Westpac Securities Limited ABN 39 087 924 221 PLEASE START HERE • Please note that you cannot use this application form to open a Westpac Cash Investment Account. If you wish to open a

Unless otherwise specified, the products and services described on this website are available only in Australia from St.George - A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL and Australian credit licence 233714. To assist with your application we request that you also download and complete the Summary of Financial Position and upload to the form below. Personal information of applicant First name

SIGNIFICANT FINANCIAL HARDSHIP – KIWISAVER Minimum living expenses generally include: By completing this application form you consent to and authorise the release of, at any time, to the manager and/or supervisor, all personal information held by any person or organisation that the manager and/or supervisor considers appropriate for the purpose of checking information provided by you in Certified Identification Required. If your account balance is over $5,000, after submitting your request via the ATO DASP Online application system, you need to send us a certified copy of a foreign passport or similar travel document that contains a photograph and signature.

Answers to our frequently asked questions. We are supplying repayment history information from April 2018, however, in line with an agreement with Government we are currently excluding this information for accounts in hardship. Certified Identification Required. If your account balance is over $5,000, after submitting your request via the ATO DASP Online application system, you need to send us a certified copy of a foreign passport or similar travel document that contains a photograph and signature.

Application for Financial Hardship Important - please read. You will require your financial information to complete this form. To protect your privacy you must complete this form in one session, if you make no entries for more than 20 minutes the form will close and your data will be deleted. To make the process easier, we suggest you print the form and manually complete it as you gather the Applying for hardship assistance What you should know. You need to be a New Zealand customer to qualify for hardship assistance. A hardship application will void any credit preapproval for ANZ products. There’s a separate application form if you’re suffering significant financial hardship and want to apply for an early withdrawal from

Financial hardship in business is more common than you might think. It’s caused by anything from staffing challenges and cash flow issues to personal injury or illness. If you're finding things tough and are struggling to see how you can make repayments, the sooner you talk to us the better. Choice head of campaigns and policy Erin Turner said Westpac should have referred James to its вЂfinancial hardship’ line the first time he called, but that the big banks were not always

We understand that life can take unexpected turns. Financial difficulty can arise from different life events such as change in income, illness, a relationship breakdown, reduction in your business cash flow or emergency events like natural disasters. Application for Financial Hardship Important - please read. You will require your financial information to complete this form. To protect your privacy you must complete this form in one session, if you make no entries for more than 20 minutes the form will close and your data will be deleted. To make the process easier, we suggest you print the form and manually complete it as you gather the

We understand that life can take unexpected turns. Financial difficulty can arise from different life events such as change in income, illness, a relationship breakdown, reduction in your business cash flow or emergency events like natural disasters. Complete the application form in full. Step 2: Collect all of the supporting documents listed in the checklist (see page 3 of the application form). We need these to determine your current financial position. Step 3: Take your application form, original identification, proof of address and proof of bank account documents to