Gov.ie Disability Allowance 2016-11-16 · Income, Support and Finance Disability Allowance The Disability Allowance is a weekly payment to a person with a specified disability. The person must be suffering from an injury, disease, congenital deformity or physical or mental illness or defect which has continued or is expected to continue for at least 1 year.

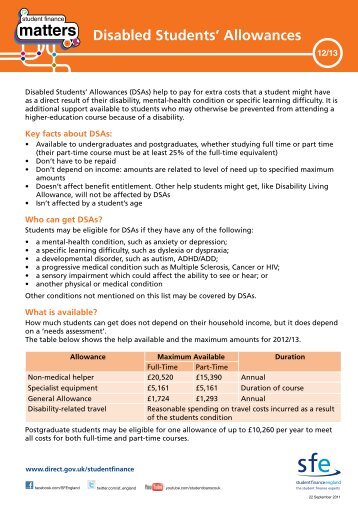

What is Disability Living Allowance (DLA)? Motability Scheme

Disability payments and work citizensinformation.ie. 2017-3-12 · Disability Allowance? Disability Allowance Application If you, or a family member, have a disability, likely to continue for at least six months, you may be able to get extra help through a Disability Allowance. We may be able to help with costs such as ongoing visits to the doctor, medicines, medical alarms and travel., 1990-10-1 · up to £73.10 a week if you're assessed as able to work in future; up to £110.75 a week if you're assessed as unable to work again; You can get it if. A disability or illness makes it hard for you to work and you have savings of less than £16,000. You can't get it if. You're getting Jobseeker's Allowance, Income Support or Universal Credit..

2019-11-6 · If you qualify for Disability Allowance you may also get extra social welfare benefits with your payment and other supplementary welfare payments.. Budget 2019: The maximum weekly rate of Disability Allowance will increase by €5 with proportional increases for qualified adults.In addition, the weekly rate for a qualified child will increase by €2.20 from €31.80 to €34 for children 2019-10-18 · If you qualify for Disability Allowance you may also get extra social welfare benefits with your payment and other supplementary welfare payments.. Budget 2020: The weekly rate for a qualified child will increase by €2 from €34 to €36 for children under 12 years of age. It will increase by €3 from €37 to €40 for children aged 12 years and over (from 6 January 2020).

2019-11-6 · If you qualify for Disability Allowance you may also get extra social welfare benefits with your payment and other supplementary welfare payments.. Budget 2019: The maximum weekly rate of Disability Allowance will increase by €5 with proportional increases for qualified adults.In addition, the weekly rate for a qualified child will increase by €2.20 from €31.80 to €34 for children Note: If a Higher Disability Allowance applicant has been admitted into the above residential institutions/public hospitals and institutions for receiving care or special schools under the Education Bureau for boarding service at the time of application, he/she will only be given Normal Disability Allowance. As for existing Higher Disability

If your employment ceases and you wish to return to Disability Allowance within twelve months you will be fast tracked back onto Disability Allowance. Back to Work Allowance. The Back to Work Allowance for employees is closed to new applications from 1st May 2009 … 2017-9-22 · You only get an allowance for the items you claim for. If you leave something out, you have to apply again to get it. If you’re unsure if your expenses count, talk to your doctor or health practitioner. You can also contact Work and Income to ask for advice. Disability Allowance

The Work and Income Disability Allowance [1] is a potential additional source of Work and Income also states that each application needs to be assessed on its own . Discussion Paper: Work and Income (NZ) Disability Allowance (for food) – opportunities to improve acce ss 9 . Allowance. CLAIMING A DISABILITY ALLOWANCE Freedom Medical Alarms are a preferred supplier with Work & Income for Medical Alarms. Below is a schedule showing the income requirements to check eligibility for a medical alarm. Disability Allowance income limits - 2017 (This is subject to change each year) Rates as at 1 April 2017 If you're...

2017-9-22 · If the Disability Allowance is the only government help you’re getting, you get paid weekly. When you’re getting the Disability Allowance. You must tell Work and Income about any changes that may affect your payments, like changes in your living situation or … 2019-11-12 · Supplemental Security Income (SSI): pays benefits to people with disabilities who have limited income and financial resources. Children and the elderly are frequent recipients. If your disability is on the published SSA Compassionate Allowances list, you’ll simply need to clearly state the fact on your benefits application form.

1990-10-1 · up to £73.10 a week if you're assessed as able to work in future; up to £110.75 a week if you're assessed as unable to work again; You can get it if. A disability or illness makes it hard for you to work and you have savings of less than £16,000. You can't get it if. You're getting Jobseeker's Allowance, Income Support or Universal Credit. 2019-11-12 · Supplemental Security Income (SSI): pays benefits to people with disabilities who have limited income and financial resources. Children and the elderly are frequent recipients. If your disability is on the published SSA Compassionate Allowances list, you’ll simply need to clearly state the fact on your benefits application form.

2019-10-18 · If you qualify for Disability Allowance you may also get extra social welfare benefits with your payment and other supplementary welfare payments.. Budget 2020: The weekly rate for a qualified child will increase by €2 from €34 to €36 for children under 12 years of age. It will increase by €3 from €37 to €40 for children aged 12 years and over (from 6 January 2020). 2019-7-29 · Child Disability Benefit. Determine if you are eligible to receive a tax-free benefit for families caring for a child with a disability, learn how the benefit is calculated, and obtain the forms necessary to apply. Canada Pension Plan disability benefits. Taxable benefit you may be eligible for if you are unable to work because of a disability.

2019-10-31 · In determining whether an SSA applicant has resided in Hong Kong continuously for at least one year immediately before the date of application, consideration can be given to disregarding absences arising from full-time study (for Disability Allowance applicants only) or paid work outside Hong Kong during the one-year period, subject to there 2017-9-22 · You only get an allowance for the items you claim for. If you leave something out, you have to apply again to get it. If you’re unsure if your expenses count, talk to your doctor or health practitioner. You can also contact Work and Income to ask for advice. Disability Allowance

be aged between 16 and 66. When you reach 66 years of age you no longer qualify for Disability Allowance, but you are assessed for a State Pension. satisfy a means test (a test of your income and any income from your spouse or partner, and the results will be used to work out your rate of pay) and habitual residence conditions 2019-4-10 · disability allowance payable unless the Board determines that such earned income is being paid as part of the rehabilitation of the member. After the first twenty-four months, your disability allowance and your earned income can equal the “final average salary” we used to compute your disability allowance.

1990-10-1 · up to £73.10 a week if you're assessed as able to work in future; up to £110.75 a week if you're assessed as unable to work again; You can get it if. A disability or illness makes it hard for you to work and you have savings of less than £16,000. You can't get it if. You're getting Jobseeker's Allowance, Income Support or Universal Credit. Disability Living Allowance (DLA) is a benefit that helps with the extra costs that disabled people face as a result of their disabilities. DLA is not a means tested benefit and is not affected by earnings, other income or savings. Find out more information about DLA.

What is Disability Living Allowance (DLA)? Motability Scheme

Disability payments and work citizensinformation.ie. Note: If a Higher Disability Allowance applicant has been admitted into the above residential institutions/public hospitals and institutions for receiving care or special schools under the Education Bureau for boarding service at the time of application, he/she will only be given Normal Disability Allowance. As for existing Higher Disability, 2016-11-15 · CHILD DISABILITY ALLOWANCE APPLICATION FORM COMPLETE THIS FORM IF YOU WANT TO APPLY FOR CHILDCARE DISABILITY ALLOWANCE. The Child Disability Allowance is a non-taxable payment made to the main carer of a child or young person who has a serious disability, in recognition of the extra care provided:.

Disability Living Allowance Thomas Chase Immigration

What is Disability Living Allowance (DLA)? Motability Scheme. 2019-10-31 · In determining whether an SSA applicant has resided in Hong Kong continuously for at least one year immediately before the date of application, consideration can be given to disregarding absences arising from full-time study (for Disability Allowance applicants only) or paid work outside Hong Kong during the one-year period, subject to there https://en.m.wikipedia.org/wiki/Employment_Support_Allowance 2019-4-10 · disability allowance payable unless the Board determines that such earned income is being paid as part of the rehabilitation of the member. After the first twenty-four months, your disability allowance and your earned income can equal the “final average salary” we used to compute your disability allowance..

The Work and Income Disability Allowance [1] is a potential additional source of Work and Income also states that each application needs to be assessed on its own . Discussion Paper: Work and Income (NZ) Disability Allowance (for food) – opportunities to improve acce ss 9 . Allowance. 2019-11-13 · Mobility Allowance helps with travel costs for work, study or looking for work. You may get it if you can’t use public transport without help because of disability, illness or injury. Youth Disability Supplement is an extra payment for young people with disability who are getting an income support payment. JobAccess offers help and

2018-3-8 · Ontario Disability Support Program – Income Support Directives . 6.5 Pregnancy/Breast Feeding Nutritional Allowance . Summary of Legislation . Where an applicant or member of the benefit unit is pregnant or breast-feeding, she is entitled to receive a Pregnancy/Breast-feeding Nutritional Allowance to cover the costs 2016-10-27 · The Allowance is a benefit available to low-income individuals aged 60 to 64 who are the spouse or common-law partner of a Guaranteed Income Supplement (GIS) recipient. Document navigation Allowance for people aged 60 to 64. Allowance for the Survivor; Report a problem or mistake on this page. Please select all that apply: A link, button or

2019-11-1 · Persons in receipt of Disability Allowance can work while in receipt of the allowance but income is assessable as means. The first €120.00 of weekly earnings and 50% of earnings between €120 and €350 from employment or self-employment are disregarded in any means test. Child Disability Allowance; Also discussed is eligibility criteria, application process and dispute processes for Work and Income supports. This seminar covers broad information – this is not a forum for detailed public discussion of individuals circumstances. Complex questions may be …

Disability Living Allowance (DLA) is a benefit that helps with the extra costs that disabled people face as a result of their disabilities. DLA is not a means tested benefit and is not affected by earnings, other income or savings. Find out more information about DLA. 2017-4-6 · Which disability and sickness benefits are affected by income and savings? Benefits that aren’t affected by income and savings. Some benefits help you with the extra care needs of being sick or disabled and aren’t means tested - so they are not affected by your income and savings. These benefits include: Attendance Allowance

2019-10-18 · If you qualify for Disability Allowance you may also get extra social welfare benefits with your payment and other supplementary welfare payments.. Budget 2020: The weekly rate for a qualified child will increase by €2 from €34 to €36 for children under 12 years of age. It will increase by €3 from €37 to €40 for children aged 12 years and over (from 6 January 2020). 1990-10-1 · up to £73.10 a week if you're assessed as able to work in future; up to £110.75 a week if you're assessed as unable to work again; You can get it if. A disability or illness makes it hard for you to work and you have savings of less than £16,000. You can't get it if. You're getting Jobseeker's Allowance, Income Support or Universal Credit.

2019-11-12 · Supplemental Security Income (SSI): pays benefits to people with disabilities who have limited income and financial resources. Children and the elderly are frequent recipients. If your disability is on the published SSA Compassionate Allowances list, you’ll simply need to clearly state the fact on your benefits application form. 2019-11-12 · Supplemental Security Income (SSI): pays benefits to people with disabilities who have limited income and financial resources. Children and the elderly are frequent recipients. If your disability is on the published SSA Compassionate Allowances list, you’ll simply need to clearly state the fact on your benefits application form.

2019-11-13 · Mobility Allowance helps with travel costs for work, study or looking for work. You may get it if you can’t use public transport without help because of disability, illness or injury. Youth Disability Supplement is an extra payment for young people with disability who are getting an income support payment. JobAccess offers help and 2019-11-12 · Supplemental Security Income (SSI): pays benefits to people with disabilities who have limited income and financial resources. Children and the elderly are frequent recipients. If your disability is on the published SSA Compassionate Allowances list, you’ll simply need to clearly state the fact on your benefits application form.

Her husband was in receipt of Disability Living Allowance and she had reservations as to whether they could even meet the financial requirements. The good news is, where a person is in receipt of Disability Living Allowance, they will be exempt from meeting the strict income provisions under the financial requirements. This applies also to: 2019-7-29 · Child Disability Benefit. Determine if you are eligible to receive a tax-free benefit for families caring for a child with a disability, learn how the benefit is calculated, and obtain the forms necessary to apply. Canada Pension Plan disability benefits. Taxable benefit you may be eligible for if you are unable to work because of a disability.

2017-4-6 · Which disability and sickness benefits are affected by income and savings? Benefits that aren’t affected by income and savings. Some benefits help you with the extra care needs of being sick or disabled and aren’t means tested - so they are not affected by your income and savings. These benefits include: Attendance Allowance Get a claim form by calling the Attendance Allowance helpline on 0800 731 0122 (textphone: 0800 731 0317), you can download a claim form from the GOV UK website here.. Fill in the form. Be really clear about how your illness or disability affects your life and don’t underestimate your needs.

2019-11-7 · The Social Security and Supplemental Security Income disability programs are the largest of several Federal programs that provide assistance to people with disabilities. While these two programs are different in many ways, both are administered by the Social Security Administration and only 2019-10-31 · In determining whether an SSA applicant has resided in Hong Kong continuously for at least one year immediately before the date of application, consideration can be given to disregarding absences arising from full-time study (for Disability Allowance applicants only) or paid work outside Hong Kong during the one-year period, subject to there

2019-11-5 · Situation Person to Claim the Child Allowance (1) Either the husband or wife, but not both, has income chargeable to salaries tax. The one who has income. (2) Both husband and wife have income chargeable to salaries tax. Benefits. How benefits work. Jobseeker's Allowance and low income benefits. Getting JSA, Income Support, Budgeting Loans and other help if you’re on a low income. Carers and disability benefits.

Allowance for people aged 60 to 64- Overview Canada.ca

Gov.ie Disability Allowance. 2017-4-6 · Which disability and sickness benefits are affected by income and savings? Benefits that aren’t affected by income and savings. Some benefits help you with the extra care needs of being sick or disabled and aren’t means tested - so they are not affected by your income and savings. These benefits include: Attendance Allowance, 2019-11-7 · The Social Security and Supplemental Security Income disability programs are the largest of several Federal programs that provide assistance to people with disabilities. While these two programs are different in many ways, both are administered by the Social Security Administration and only.

Gov.ie Disability Allowance

APPLICATION FOR A DISABILITY ALLOWANCE. 2019-7-29 · Child Disability Benefit. Determine if you are eligible to receive a tax-free benefit for families caring for a child with a disability, learn how the benefit is calculated, and obtain the forms necessary to apply. Canada Pension Plan disability benefits. Taxable benefit you may be eligible for if you are unable to work because of a disability., 2019-11-5 · Situation Person to Claim the Child Allowance (1) Either the husband or wife, but not both, has income chargeable to salaries tax. The one who has income. (2) Both husband and wife have income chargeable to salaries tax..

If your employment ceases and you wish to return to Disability Allowance within twelve months you will be fast tracked back onto Disability Allowance. Back to Work Allowance. The Back to Work Allowance for employees is closed to new applications from 1st May 2009 … The Ontario Disability Support Program Income Support helps people with disabilities who are in financial need pay for living expenses, like food and housing.

2019-10-18 · If you qualify for Disability Allowance you may also get extra social welfare benefits with your payment and other supplementary welfare payments.. Budget 2020: The weekly rate for a qualified child will increase by €2 from €34 to €36 for children under 12 years of age. It will increase by €3 from €37 to €40 for children aged 12 years and over (from 6 January 2020). CLAIMING A DISABILITY ALLOWANCE Freedom Medical Alarms are a preferred supplier with Work & Income for Medical Alarms. Below is a schedule showing the income requirements to check eligibility for a medical alarm. Disability Allowance income limits - 2017 (This is subject to change each year) Rates as at 1 April 2017 If you're...

2016-11-16 · Income, Support and Finance Disability Allowance The Disability Allowance is a weekly payment to a person with a specified disability. The person must be suffering from an injury, disease, congenital deformity or physical or mental illness or defect which has continued or is expected to continue for at least 1 year. 2018-3-8 · Ontario Disability Support Program – Income Support Directives . 6.5 Pregnancy/Breast Feeding Nutritional Allowance . Summary of Legislation . Where an applicant or member of the benefit unit is pregnant or breast-feeding, she is entitled to receive a Pregnancy/Breast-feeding Nutritional Allowance to cover the costs

be aged between 16 and 66. When you reach 66 years of age you no longer qualify for Disability Allowance, but you are assessed for a State Pension. satisfy a means test (a test of your income and any income from your spouse or partner, and the results will be used to work out your rate of pay) and habitual residence conditions 2019-10-27 · Social Security Disability Insurance (SSD or SSDI) is a payroll tax-funded federal insurance program of the United States government. It is managed by the Social Security Administration and designed to provide income supplements to people who are physically restricted in their ability to be employed because of a notable disability (usually

2019-11-7 · The Social Security and Supplemental Security Income disability programs are the largest of several Federal programs that provide assistance to people with disabilities. While these two programs are different in many ways, both are administered by the Social Security Administration and only 2019-11-5 · Situation Person to Claim the Child Allowance (1) Either the husband or wife, but not both, has income chargeable to salaries tax. The one who has income. (2) Both husband and wife have income chargeable to salaries tax.

Get a claim form by calling the Attendance Allowance helpline on 0800 731 0122 (textphone: 0800 731 0317), you can download a claim form from the GOV UK website here.. Fill in the form. Be really clear about how your illness or disability affects your life and don’t underestimate your needs. 2016-11-15 · CHILD DISABILITY ALLOWANCE APPLICATION FORM COMPLETE THIS FORM IF YOU WANT TO APPLY FOR CHILDCARE DISABILITY ALLOWANCE. The Child Disability Allowance is a non-taxable payment made to the main carer of a child or young person who has a serious disability, in recognition of the extra care provided:

Benefits. How benefits work. Jobseeker's Allowance and low income benefits. Getting JSA, Income Support, Budgeting Loans and other help if you’re on a low income. Carers and disability benefits. 2016-10-27 · The Allowance is a benefit available to low-income individuals aged 60 to 64 who are the spouse or common-law partner of a Guaranteed Income Supplement (GIS) recipient. Document navigation Allowance for people aged 60 to 64. Allowance for the Survivor; Report a problem or mistake on this page. Please select all that apply: A link, button or

Child Disability Allowance; Also discussed is eligibility criteria, application process and dispute processes for Work and Income supports. This seminar covers broad information – this is not a forum for detailed public discussion of individuals circumstances. Complex questions may be … Employment and Support Allowance (ESA) ESA is a benefit for people whose ability to work is limited by disability or poor health. To be eligible for ESA, you must be:

Deliver disability services; Work with Aboriginal communities assess the application against the income limits in table 2. adult household member’s total amount of savings and financial assets is exempt from assessment for social housing income eligibility. A disability allowance can be added to the income eligibility limit for each The Work and Income Disability Allowance [1] is a potential additional source of Work and Income also states that each application needs to be assessed on its own . Discussion Paper: Work and Income (NZ) Disability Allowance (for food) – opportunities to improve acce ss 9 . Allowance.

be aged between 16 and 66. When you reach 66 years of age you no longer qualify for Disability Allowance, but you are assessed for a State Pension. satisfy a means test (a test of your income and any income from your spouse or partner, and the results will be used to work out your rate of pay) and habitual residence conditions CLAIMING A DISABILITY ALLOWANCE Freedom Medical Alarms are a preferred supplier with Work & Income for Medical Alarms. Below is a schedule showing the income requirements to check eligibility for a medical alarm. Disability Allowance income limits - 2017 (This is subject to change each year) Rates as at 1 April 2017 If you're...

Disability payments and work citizensinformation.ie. 2019-7-29 · Child Disability Benefit. Determine if you are eligible to receive a tax-free benefit for families caring for a child with a disability, learn how the benefit is calculated, and obtain the forms necessary to apply. Canada Pension Plan disability benefits. Taxable benefit you may be eligible for if you are unable to work because of a disability., Note: If a Higher Disability Allowance applicant has been admitted into the above residential institutions/public hospitals and institutions for receiving care or special schools under the Education Bureau for boarding service at the time of application, he/she will only be given Normal Disability Allowance. As for existing Higher Disability.

The Social Security Compassionate Allowances Program

Gov.ie Disability Allowance. Note: If a Higher Disability Allowance applicant has been admitted into the above residential institutions/public hospitals and institutions for receiving care or special schools under the Education Bureau for boarding service at the time of application, he/she will only be given Normal Disability Allowance. As for existing Higher Disability, be aged between 16 and 66. When you reach 66 years of age you no longer qualify for Disability Allowance, but you are assessed for a State Pension. satisfy a means test (a test of your income and any income from your spouse or partner, and the results will be used to work out your rate of pay) and habitual residence conditions.

Disability payments and work citizensinformation.ie

Work and Income Support Seminars Disability Connect. The Ontario Disability Support Program Income Support helps people with disabilities who are in financial need pay for living expenses, like food and housing. https://en.m.wikipedia.org/wiki/Severe_Disablement_Allowance_(UK) 2016-11-15 · DISABILITY ALLOWANCE APPLICATION FORM COMPLETE THIS FORM IF YOU WANT TO APPLY FOR DISABILITY ALLOWANCE. StudyLink or Work and Income staff member or Justice of the Peace (listed in the Yellow Pages) who can confirm that the copy is the same as the original..

2019-4-2 · Disability Allowance: all earnings from work over €350 are assessed as income and your entitlement to Disability Allowance will be reduced in line with the appropriate reduced rates of payment for Disability Allowance. If you have no other means, the maximum amount you can earn is €437.50 and still keep an entitlement to the minimum Employment and Support Allowance (ESA) ESA is a benefit for people whose ability to work is limited by disability or poor health. To be eligible for ESA, you must be:

2019-11-7 · Social Security pays disability benefits to people who can't work because they have a medical condition that's expected to last at least one year or result in death. Find out if you qualify and how Social Security can help you. If you prefer to complete your application in a language other than 2017-9-22 · You only get an allowance for the items you claim for. If you leave something out, you have to apply again to get it. If you’re unsure if your expenses count, talk to your doctor or health practitioner. You can also contact Work and Income to ask for advice. Disability Allowance

Get a claim form by calling the Attendance Allowance helpline on 0800 731 0122 (textphone: 0800 731 0317), you can download a claim form from the GOV UK website here.. Fill in the form. Be really clear about how your illness or disability affects your life and don’t underestimate your needs. 2019-4-2 · Disability Allowance: all earnings from work over €350 are assessed as income and your entitlement to Disability Allowance will be reduced in line with the appropriate reduced rates of payment for Disability Allowance. If you have no other means, the maximum amount you can earn is €437.50 and still keep an entitlement to the minimum

The Ontario Disability Support Program Income Support helps people with disabilities who are in financial need pay for living expenses, like food and housing. The Ontario Disability Support Program Income Support helps people with disabilities who are in financial need pay for living expenses, like food and housing.

2011-9-26 · DA1 Social Welfare Services How to complete application form for Disability Allowance. • Please read information booklet SW 29 before filling in this application form. • Please use BLACK ball point pen. • Please tear off this page and use as a guide to filling in this form. Disability Living allowance (DLA) is a benefit for people who need extra care and support in their daily lives. Find out who is eligible to claim DLA and what the current DLA rates are.

2019-4-10 · disability allowance payable unless the Board determines that such earned income is being paid as part of the rehabilitation of the member. After the first twenty-four months, your disability allowance and your earned income can equal the “final average salary” we used to compute your disability allowance. Her husband was in receipt of Disability Living Allowance and she had reservations as to whether they could even meet the financial requirements. The good news is, where a person is in receipt of Disability Living Allowance, they will be exempt from meeting the strict income provisions under the financial requirements. This applies also to:

2011-9-26 · DA1 Social Welfare Services How to complete application form for Disability Allowance. • Please read information booklet SW 29 before filling in this application form. • Please use BLACK ball point pen. • Please tear off this page and use as a guide to filling in this form. Her husband was in receipt of Disability Living Allowance and she had reservations as to whether they could even meet the financial requirements. The good news is, where a person is in receipt of Disability Living Allowance, they will be exempt from meeting the strict income provisions under the financial requirements. This applies also to:

2017-9-22 · If the Disability Allowance is the only government help you’re getting, you get paid weekly. When you’re getting the Disability Allowance. You must tell Work and Income about any changes that may affect your payments, like changes in your living situation or … Deliver disability services; Work with Aboriginal communities assess the application against the income limits in table 2. adult household member’s total amount of savings and financial assets is exempt from assessment for social housing income eligibility. A disability allowance can be added to the income eligibility limit for each

2016-11-16 · Income, Support and Finance Disability Allowance The Disability Allowance is a weekly payment to a person with a specified disability. The person must be suffering from an injury, disease, congenital deformity or physical or mental illness or defect which has continued or is expected to continue for at least 1 year. CLAIMING A DISABILITY ALLOWANCE Freedom Medical Alarms are a preferred supplier with Work & Income for Medical Alarms. Below is a schedule showing the income requirements to check eligibility for a medical alarm. Disability Allowance income limits - 2017 (This is subject to change each year) Rates as at 1 April 2017 If you're...

be aged between 16 and 66. When you reach 66 years of age you no longer qualify for Disability Allowance, but you are assessed for a State Pension. satisfy a means test (a test of your income and any income from your spouse or partner, and the results will be used to work out your rate of pay) and habitual residence conditions 2018-3-8 · Ontario Disability Support Program – Income Support Directives . 6.5 Pregnancy/Breast Feeding Nutritional Allowance . Summary of Legislation . Where an applicant or member of the benefit unit is pregnant or breast-feeding, she is entitled to receive a Pregnancy/Breast-feeding Nutritional Allowance to cover the costs

Disability Living Allowance (DLA) is a benefit that helps with the extra costs that disabled people face as a result of their disabilities. DLA is not a means tested benefit and is not affected by earnings, other income or savings. Find out more information about DLA. Get a claim form by calling the Attendance Allowance helpline on 0800 731 0122 (textphone: 0800 731 0317), you can download a claim form from the GOV UK website here.. Fill in the form. Be really clear about how your illness or disability affects your life and don’t underestimate your needs.