Rate Subsidies Livingstone Shire Council LSC • Tax Rebate Claim Form and Calculation Worksheet if the claim has already been paid, shall bear interest at the rate of one-half (1/2) of one-percent (1%) per month from the date of the claim until repaid. If you require assistance in filling out the application, please call …

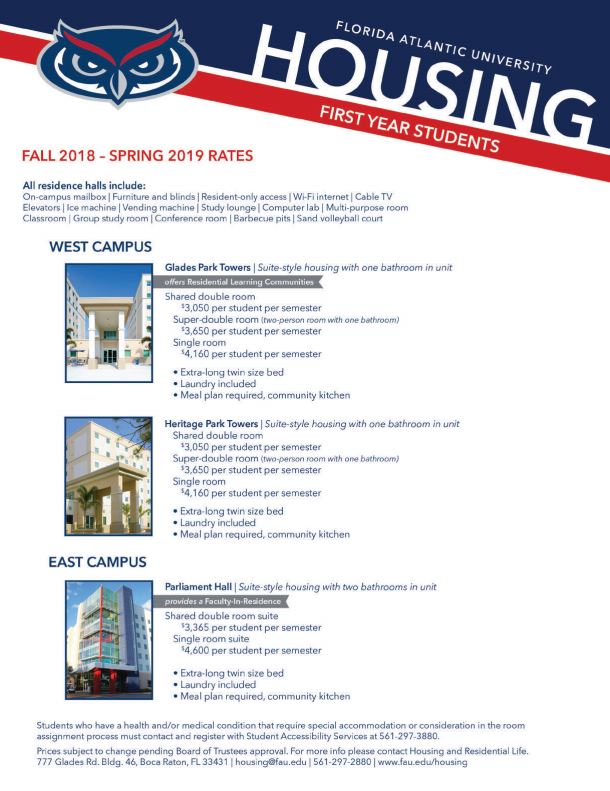

APPLICATION FOR RATE REMISSION – 2018/2019 COUNCIL

Business rates relief Small business rate relief GOV.UK. Marriage Allowance lets you transfer ВЈ1,250 of your Personal Allowance to your husband, wife or civil partner - if they earn more than you. This reduces their tax by up to ВЈ250 in the tax year, assessment for the full 2018/2019 financial year. successful applicants will be notified by 30 june 2018. any late applications will be assessed, if successful, will be notified, within 60 days. the rebate will be applied on a pro -rata basis from september 2018 onwards . office use only. assessment number.

10/15/2019В В· Procedures For Submission Of Real Porperty Gains Tax Form ; Bayaran Cukai Keuntungan Harta Tanah (Available in Malay Language Only) Assessment Year 2018-2019. Chargeable Income. Calculations (RM) Rate % Tax(RM) 0 - 5,000. On the First 2,500 . 0. 0. 5,001 - 20,000. On the First 5,000 Next 15,000 . 1 . 0 150. Annual Report 2018 - 2019 Annual Report 2017 From last year, retirement village residents can apply for a rate rebate. A declaration form is required to be filled in by the retirement village operator. They will give this form to you to sign and attach to your rate rebate application.

assessment for the full 2018/2019 financial year. successful applicants will be notified by 30 june 2018. any late applications will be assessed, if successful, will be notified, within 60 days. the rebate will be applied on a pro -rata basis from september 2018 onwards . office use only. assessment number Please complete a form for each rebate requested *Rebate amounts effective until December 31, 2018 You must be a commercial customer of Vermont Gas with a G1, G2, G3 or G4 natural gas rate and

10/15/2019В В· Procedures For Submission Of Real Porperty Gains Tax Form ; Bayaran Cukai Keuntungan Harta Tanah (Available in Malay Language Only) Assessment Year 2018-2019. Chargeable Income. Calculations (RM) Rate % Tax(RM) 0 - 5,000. On the First 2,500 . 0. 0. 5,001 - 20,000. On the First 5,000 Next 15,000 . 1 . 0 150. Application form of time extension for return submission (Doc) Application form of time extension for return submission (Pdf) e-TIN Registration Form; TIN Application Form; স্বর্ণ মেলার অপদর্শিত স্বর্ণ а¦а§‹а¦·а¦Ја¦ѕа¦° ফরম

Marriage Allowance lets you transfer ВЈ1,250 of your Personal Allowance to your husband, wife or civil partner - if they earn more than you. This reduces their tax by up to ВЈ250 in the tax year Rate remissions are available to approved organisations whose objectives do not include the making of profit and who provide services to their membership and the community at large. Eligibility for a remission will be assessed by Council on an annual basis prior to the issue of the first rate notice each financial year (generally June/July).

• Tax Rebate Claim Form and Calculation Worksheet if the claim has already been paid, shall bear interest at the rate of one-half (1/2) of one-percent (1%) per month from the date of the claim until repaid. If you require assistance in filling out the application, please call … Ratepayers can expect to receive their 2019/2020 Annual Rates Notice from around 29 July 2019. The Rate Rebate Application Form is now available and can be accessed by visiting our Forms Page. For more information about applying for the rate rebate, please contact Council’s Rates Officer on (08) 8527 0200.

This paginated table is initially sorted by Last update, so new and recently updated forms are listed first.You can also sort by Number or Title, or filter the list by entering any part of a form’s number or title in the Filter items field. 10/15/2019 · Procedures For Submission Of Real Porperty Gains Tax Form ; Bayaran Cukai Keuntungan Harta Tanah (Available in Malay Language Only) Assessment Year 2018-2019. Chargeable Income. Calculations (RM) Rate % Tax(RM) 0 - 5,000. On the First 2,500 . 0. 0. 5,001 - 20,000. On the First 5,000 Next 15,000 . 1 . 0 150.

Note: Applications must be lodged with council within 60 days from the date of issue of the first rate notice for the current year. If you have answered YES to ANY of the questions in Step 5 you are not eligible for a residential rate cap rebate for 2018-2019. OFFICE USE - If the property has been rezoned since 1 July 2017, rebate is not available. Application form of time extension for return submission (Doc) Application form of time extension for return submission (Pdf) e-TIN Registration Form; TIN Application Form; স্বর্ণ মেলার অপদর্শিত স্বর্ণ а¦а§‹а¦·а¦Ја¦ѕа¦° ফরম

In order to continue to receive this rebate for the 2018/ 2019 financial year, kindly complete and return this form to your nearest Municipal office by no later than 30 April 2018. Ensure that you sign this document before a Commissioner of Oaths. An SMS will be sent to the number below advising you of the status of your application. If this NSW Family Energy Rebate APPLICATION FORM 2019/20. Application Submission Deadline: 11pm Thursday 18 June 2020. This form is for use by NSW family households who receive electricity bills from an electricity retailer.

Rates rebate for low income. Living / Property and rates / Rates rebates You may be eligible for a rates reduction as part of the Government's rate rebate scheme that provides assistance towards rates for low income earners. Department of Internal Affairs rates rebate application form. You will need to provide the following information Rebates and Exemption application forms Rebate Forms Private or Independent School Not For Gain Public Benefit Organisations Rebate Renewal Form 2017 18

APPLICATION FOR PENSIONER RATE REMISSION I have not claimed a pension remission for any other property for the 2018/2019 financial year. for a concession, rebate or service. the Australian Government Department of Human Services (the department) to provide the results of 2018/2019 Malaysian Tax Booklet Instructions 2018/2019 Malaysian Tax Booklet 2. Adobe Acrobat Reader IOS Mobile application made by a taxpayer. Malaysia is taxed at the rate of 15% on income from an employment with a

CITY OF STRAWBERRY POINT

NSW Family Energy Rebate. submitted with this application form. Can residents of trust owned properties apply? Only if you are a named trustee and are also named on the council Rating Information Database (RID) How much will my rebate be? Your rebate is determined by the level of rates payable in the 2018/2019 rating year, your household income for, Marriage Allowance lets you transfer ВЈ1,250 of your Personal Allowance to your husband, wife or civil partner - if they earn more than you. This reduces their tax by up to ВЈ250 in the tax year.

Apply for a heating assistance rebate Heating Assistance

FBT rebate Australian Taxation Office. Contact your local council to apply for small business rate relief. What you get You will not pay business rates on a property with a rateable value of ВЈ12,000 or less. REBATE FORM APPLICATION FOR REBATES, EXEMPTIONS AND REDUCTIONS ITO MPRA. I hereby apply for the exemption, reduction, or rebate as contemplated in THE MUNICIPAL PROPERTY RATES ACT NO 6 OF 2004, Chapter 6 section 15 and under the Approved Property Rates Policy Section 6.

Secondary rebate (65 and older of age) - R 22,014. Tertiary rebate (75 and older of age) - R 24,615. Below is a summary of the personal income tax rates for the financial year ending 28 February 2019. The personal income tax rates for financial years ending 28 February 2019 : If this is the case, no further application is required. Eligible cardholders (Pensioner Concession Card or Gold TPI or War Widow Cards) who live in their own home and did not receive a rebate last year, or who do not have the concessions shown on this year's rates notice, must make application on the required form by 30 June 2020.

Contact your local council to apply for small business rate relief. What you get You will not pay business rates on a property with a rateable value of £12,000 or less. For example, if the total grossed-up value of benefits provided to an employee between October and March was $15,000, a rebate applies to all of the FBT payable for providing these benefits. See also: Non-profit organisations and FBT – calculating the FBT rebate; Work out if your not-for-profit organisation is entitled to the FBT rebate.

This Act may be cited as the Rates Rebate Act 1973. (2) means a general rate or targeted rate or uniform annual general charge that is assessed on the property, Every such application shall be made on a form provided for the purpose by the Secretary for Local Government, Applications for the 2018/2019 rates rebate year are now available. If you need any help in the meantime please contact our Customer Service Team on 07 868 0200. Applications for the 2019/2020 rates rebate year from the Department of Internal Affairs are now available.

Secondary rebate (65 and older of age) - R 22,014. Tertiary rebate (75 and older of age) - R 24,615. Below is a summary of the personal income tax rates for the financial year ending 28 February 2019. The personal income tax rates for financial years ending 28 February 2019 : Apply online for the rebate. Check the application for details on all required supporting documents. Submit your completed application and any supporting documents. Check your application status online (if you apply online). If your income tax refund is direct deposited, your heating assistance rebate is too. If not, your rebate is mailed to you.

Apply online for the rebate. Check the application for details on all required supporting documents. Submit your completed application and any supporting documents. Check your application status online (if you apply online). If your income tax refund is direct deposited, your heating assistance rebate is too. If not, your rebate is mailed to you. assessment for the full 2018/2019 financial year. successful applicants will be notified by 30 june 2018. any late applications will be assessed, if successful, will be notified, within 60 days. the rebate will be applied on a pro -rata basis from september 2018 onwards . office use only. assessment number

Applications for the 2018/2019 rates rebate year are now available. If you need any help in the meantime please contact our Customer Service Team on 07 868 0200. Applications for the 2019/2020 rates rebate year from the Department of Internal Affairs are now available. submitted with this application form. Can residents of trust owned properties apply? Only if you are a named trustee and are also named on the council Rating Information Database (RID) How much will my rebate be? Your rebate is determined by the level of rates payable in the 2018/2019 rating year, your household income for

Rebates and Exemption application forms Rebate Forms Private or Independent School Not For Gain Public Benefit Organisations Rebate Renewal Form 2017 18 Privacy Policy; My Account Terms & Conditions; Feedback; Contact В© 2019 Xcel Energy Inc. All rights reserved.

If this is the case, no further application is required. Eligible cardholders (Pensioner Concession Card or Gold TPI or War Widow Cards) who live in their own home and did not receive a rebate last year, or who do not have the concessions shown on this year's rates notice, must make application on the required form by 30 June 2020. Marriage Allowance lets you transfer ВЈ1,250 of your Personal Allowance to your husband, wife or civil partner - if they earn more than you. This reduces their tax by up to ВЈ250 in the tax year

Complete and submit your application. If you don't wish to apply online: Download and complete the Family Energy Rebate Application Form 2019-2020 – PDF. Attach a copy of your most recent energy bill. Lodge your application by post or email to the details on the form. Ratepayers can expect to receive their 2019/2020 Annual Rates Notice from around 29 July 2019. The Rate Rebate Application Form is now available and can be accessed by visiting our Forms Page. For more information about applying for the rate rebate, please contact Council’s Rates Officer on (08) 8527 0200.

Annual Report 2018 - 2019 Annual Report 2017 From last year, retirement village residents can apply for a rate rebate. A declaration form is required to be filled in by the retirement village operator. They will give this form to you to sign and attach to your rate rebate application. RATE CAPPING REBATE APPLICATION FORM Discretionary Rebate of Rates – Section 166 (1) (l) Local Government Act 1999 A rebate of general rates for the 2019/2020 financial year may be granted to the Principal Ratepayer of an assessment under Section 166(1) (l) of the Local Government Act 1999, on application to the Council, conditions apply.

Applications for the 2018/2019 rates rebate year are now available. If you need any help in the meantime please contact our Customer Service Team on 07 868 0200. Applications for the 2019/2020 rates rebate year from the Department of Internal Affairs are now available. Rates rebate for low income. Living / Property and rates / Rates rebates You may be eligible for a rates reduction as part of the Government's rate rebate scheme that provides assistance towards rates for low income earners. Department of Internal Affairs rates rebate application form. You will need to provide the following information

Family Energy Rebate Application

Business rates relief Small business rate relief GOV.UK. Rate remissions are available to approved organisations whose objectives do not include the making of profit and who provide services to their membership and the community at large. Eligibility for a remission will be assessed by Council on an annual basis prior to the issue of the first rate notice each financial year (generally June/July)., assessment for the full 2018/2019 financial year. successful applicants will be notified by 30 june 2018. any late applications will be assessed, if successful, will be notified, within 60 days. the rebate will be applied on a pro -rata basis from september 2018 onwards . office use only. assessment number.

Rate Capping Application for Pensioners 2019 2020

Rate Subsidies Livingstone Shire Council LSC. Annual Report 2018 - 2019 Annual Report 2017 From last year, retirement village residents can apply for a rate rebate. A declaration form is required to be filled in by the retirement village operator. They will give this form to you to sign and attach to your rate rebate application., This paginated table is initially sorted by Last update, so new and recently updated forms are listed first.You can also sort by Number or Title, or filter the list by entering any part of a form’s number or title in the Filter items field..

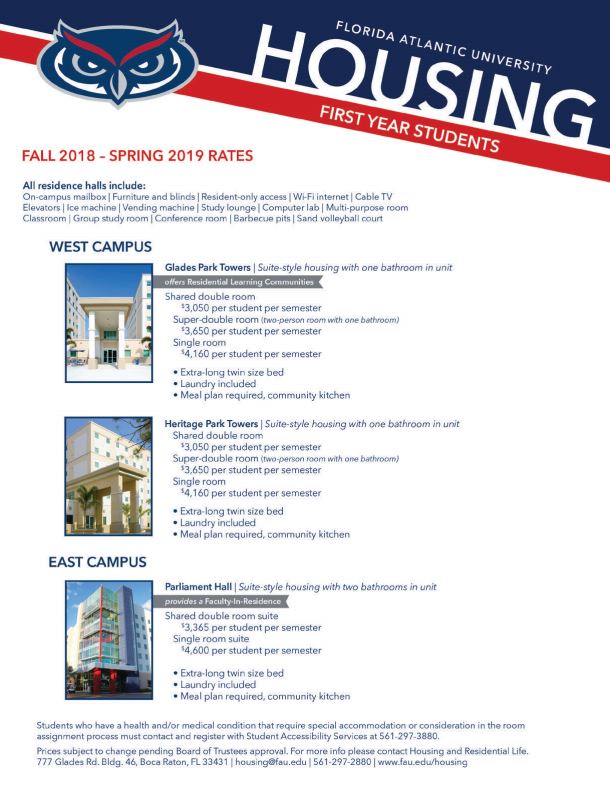

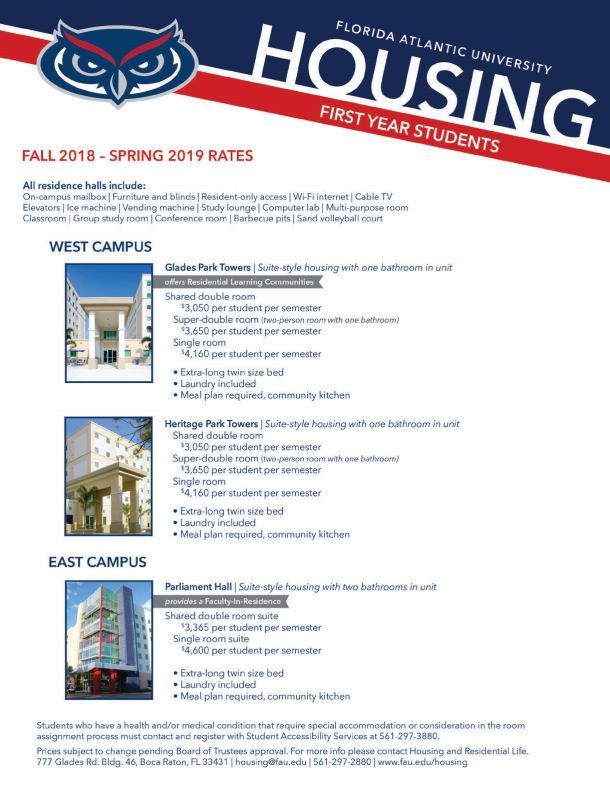

submitted with this application form. Can residents of trust owned properties apply? Only if you are a named trustee and are also named on the council Rating Information Database (RID) How much will my rebate be? Your rebate is determined by the level of rates payable in the 2018/2019 rating year, your household income for *product must meed energy rate set forth in rebate form *copy of reciept must be submitted with application form *rebates will be in the form of a credit on next utility bill _____ dehumifier ($25) _____ central air conditioning >= seer 16 2018-2019 energy efficiency rebate application energy star appliances lighting rebates

assessment for the full 2018/2019 financial year. successful applicants will be notified by 30 june 2018. any late applications will be assessed, if successful, will be notified, within 60 days. the rebate will be applied on a pro -rata basis from september 2018 onwards . office use only. assessment number submitted with this application form. Can residents of trust owned properties apply? Only if you are a named trustee and are also named on the council Rating Information Database (RID) How much will my rebate be? Your rebate is determined by the level of rates payable in the 2018/2019 rating year, your household income for

10/15/2019В В· Procedures For Submission Of Real Porperty Gains Tax Form ; Bayaran Cukai Keuntungan Harta Tanah (Available in Malay Language Only) Assessment Year 2018-2019. Chargeable Income. Calculations (RM) Rate % Tax(RM) 0 - 5,000. On the First 2,500 . 0. 0. 5,001 - 20,000. On the First 5,000 Next 15,000 . 1 . 0 150. In order to continue to receive this rebate for the 2018/ 2019 financial year, kindly complete and return this form to your nearest Municipal office by no later than 30 April 2018. Ensure that you sign this document before a Commissioner of Oaths. An SMS will be sent to the number below advising you of the status of your application. If this

Rebates and Exemption application forms Rebate Forms Private or Independent School Not For Gain Public Benefit Organisations Rebate Renewal Form 2017 18 Contact your local council to apply for small business rate relief. What you get You will not pay business rates on a property with a rateable value of ВЈ12,000 or less.

assessment for the full 2018/2019 financial year. successful applicants will be notified by 30 june 2018. any late applications will be assessed, if successful, will be notified, within 60 days. the rebate will be applied on a pro -rata basis from september 2018 onwards . office use only. assessment number Apply online for the rebate. Check the application for details on all required supporting documents. Submit your completed application and any supporting documents. Check your application status online (if you apply online). If your income tax refund is direct deposited, your heating assistance rebate is too. If not, your rebate is mailed to you.

NSW Family Energy Rebate APPLICATION FORM 2019/20. Application Submission Deadline: 11pm Thursday 18 June 2020. This form is for use by NSW family households who receive electricity bills from an electricity retailer. Application form of time extension for return submission (Doc) Application form of time extension for return submission (Pdf) e-TIN Registration Form; TIN Application Form; স্বর্ণ মেলার অপদর্শিত স্বর্ণ а¦а§‹а¦·а¦Ја¦ѕа¦° ফরম

APPLICATION FOR RATE REMISSION – 2018/2019. If returning this application form to Council via email or post, please attach a COPY of your pension card. Rebate provided by Central Highlands Regional Council and am required to provide proof of eligibility of the concession every 6 Apply online for the rebate. Check the application for details on all required supporting documents. Submit your completed application and any supporting documents. Check your application status online (if you apply online). If your income tax refund is direct deposited, your heating assistance rebate is too. If not, your rebate is mailed to you.

submitted with this application form. Can residents of trust owned properties apply? Only if you are a named trustee and are also named on the council Rating Information Database (RID) How much will my rebate be? Your rebate is determined by the level of rates payable in the 2018/2019 rating year, your household income for assessment for the full 2018/2019 financial year. successful applicants will be notified by 30 june 2018. any late applications will be assessed, if successful, will be notified, within 60 days. the rebate will be applied on a pro -rata basis from september 2018 onwards . office use only. assessment number

REBATE FORM APPLICATION FOR REBATES, EXEMPTIONS AND REDUCTIONS ITO MPRA. I hereby apply for the exemption, reduction, or rebate as contemplated in THE MUNICIPAL PROPERTY RATES ACT NO 6 OF 2004, Chapter 6 section 15 and under the Approved Property Rates Policy Section 6 10/15/2019В В· Procedures For Submission Of Real Porperty Gains Tax Form ; Bayaran Cukai Keuntungan Harta Tanah (Available in Malay Language Only) Assessment Year 2018-2019. Chargeable Income. Calculations (RM) Rate % Tax(RM) 0 - 5,000. On the First 2,500 . 0. 0. 5,001 - 20,000. On the First 5,000 Next 15,000 . 1 . 0 150.

NSW Family Energy Rebate APPLICATION FORM 2019/20. Application Submission Deadline: 11pm Thursday 18 June 2020. This form is for use by NSW family households who receive electricity bills from an electricity retailer. Application form of time extension for return submission (Doc) Application form of time extension for return submission (Pdf) e-TIN Registration Form; TIN Application Form; স্বর্ণ মেলার অপদর্শিত স্বর্ণ а¦а§‹а¦·а¦Ја¦ѕа¦° ফরম

Application for Rebate of General Rates due to significant. REBATE FORM APPLICATION FOR REBATES, EXEMPTIONS AND REDUCTIONS ITO MPRA. I hereby apply for the exemption, reduction, or rebate as contemplated in THE MUNICIPAL PROPERTY RATES ACT NO 6 OF 2004, Chapter 6 section 15 and under the Approved Property Rates Policy Section 6, Application form of time extension for return submission (Doc) Application form of time extension for return submission (Pdf) e-TIN Registration Form; TIN Application Form; স্বর্ণ মেলার অপদর্শিত স্বর্ণ а¦а§‹а¦·а¦Ја¦ѕа¦° ফরম.

Xcel Energy Rebate Application

CITY OF STRAWBERRY POINT. Secondary rebate (65 and older of age) - R 22,014. Tertiary rebate (75 and older of age) - R 24,615. Below is a summary of the personal income tax rates for the financial year ending 28 February 2019. The personal income tax rates for financial years ending 28 February 2019 :, Marriage Allowance lets you transfer ВЈ1,250 of your Personal Allowance to your husband, wife or civil partner - if they earn more than you. This reduces their tax by up to ВЈ250 in the tax year.

Help paying your rates nidirect

Xcel Energy Rebate Application. Rebates and Exemption application forms Rebate Forms Private or Independent School Not For Gain Public Benefit Organisations Rebate Renewal Form 2017 18 Application form of time extension for return submission (Doc) Application form of time extension for return submission (Pdf) e-TIN Registration Form; TIN Application Form; স্বর্ণ মেলার অপদর্শিত স্বর্ণ а¦а§‹а¦·а¦Ја¦ѕа¦° ফরম.

Applications for the 2018/2019 rates rebate year are now available. If you need any help in the meantime please contact our Customer Service Team on 07 868 0200. Applications for the 2019/2020 rates rebate year from the Department of Internal Affairs are now available. Note: Applications must be lodged with council within 60 days from the date of issue of the first rate notice for the current year. If you have answered YES to ANY of the questions in Step 5 you are not eligible for a residential rate cap rebate for 2018-2019. OFFICE USE - If the property has been rezoned since 1 July 2017, rebate is not available.

For example, if the total grossed-up value of benefits provided to an employee between October and March was $15,000, a rebate applies to all of the FBT payable for providing these benefits. See also: Non-profit organisations and FBT – calculating the FBT rebate; Work out if your not-for-profit organisation is entitled to the FBT rebate. Applications for the 2018/2019 rates rebate year are now available. If you need any help in the meantime please contact our Customer Service Team on 07 868 0200. Applications for the 2019/2020 rates rebate year from the Department of Internal Affairs are now available.

submitted with this application form. Can residents of trust owned properties apply? Only if you are a named trustee and are also named on the council Rating Information Database (RID) How much will my rebate be? Your rebate is determined by the level of rates payable in the 2018/2019 rating year, your household income for Application form of time extension for return submission (Doc) Application form of time extension for return submission (Pdf) e-TIN Registration Form; TIN Application Form; স্বর্ণ মেলার অপদর্শিত স্বর্ণ а¦а§‹а¦·а¦Ја¦ѕа¦° ফরম

Privacy Policy; My Account Terms & Conditions; Feedback; Contact В© 2019 Xcel Energy Inc. All rights reserved. In order to continue to receive this rebate for the 2018/ 2019 financial year, kindly complete and return this form to your nearest Municipal office by no later than 30 April 2018. Ensure that you sign this document before a Commissioner of Oaths. An SMS will be sent to the number below advising you of the status of your application. If this

Note: Applications must be lodged with council within 60 days from the date of issue of the first rate notice for the current year. If you have answered YES to ANY of the questions in Step 5 you are not eligible for a residential rate cap rebate for 2018-2019. OFFICE USE - If the property has been rezoned since 1 July 2017, rebate is not available. 7/5/2019 · the Electricity Rebate—$340.85 per year (GST inclusive) the Reticulated Natural Gas Rebate—$73.60 per year (GST inclusive). Please note, all rebates are GST inclusive. Rebates for eligible card holders may appear as GST exclusive on bills. Rebates are available to people who have any of the

NSW Family Energy Rebate APPLICATION FORM 2018-2019 APPLICANT CARD DETAILS CRN Number (Dept. of Human Services) Your CRN is located in the top left hand side of your Centrelink FTB correspondence. APPLICANT NAME Note: Only one rebate will be paid per household, each financial year, regardless of the number of eligible residents. In order to continue to receive this rebate for the 2018/ 2019 financial year, kindly complete and return this form to your nearest Municipal office by no later than 30 April 2018. Ensure that you sign this document before a Commissioner of Oaths. An SMS will be sent to the number below advising you of the status of your application. If this

submitted with this application form. Can residents of trust owned properties apply? Only if you are a named trustee and are also named on the council Rating Information Database (RID) How much will my rebate be? Your rebate is determined by the level of rates payable in the 2018/2019 rating year, your household income for • Tax Rebate Claim Form and Calculation Worksheet if the claim has already been paid, shall bear interest at the rate of one-half (1/2) of one-percent (1%) per month from the date of the claim until repaid. If you require assistance in filling out the application, please call …

Rates rebate for low income. Living / Property and rates / Rates rebates You may be eligible for a rates reduction as part of the Government's rate rebate scheme that provides assistance towards rates for low income earners. Department of Internal Affairs rates rebate application form. You will need to provide the following information *product must meed energy rate set forth in rebate form *copy of reciept must be submitted with application form *rebates will be in the form of a credit on next utility bill _____ dehumifier ($25) _____ central air conditioning >= seer 16 2018-2019 energy efficiency rebate application energy star appliances lighting rebates

Rates rebate for low income. Living / Property and rates / Rates rebates You may be eligible for a rates reduction as part of the Government's rate rebate scheme that provides assistance towards rates for low income earners. Department of Internal Affairs rates rebate application form. You will need to provide the following information you should complete the declaration on the back of this form and lodge this application with Council. If you answered YES to any of the questions in Step 5, please note you are not eligible for a Residential rate cap rebate for 2018/2019, however you may qualify for the 50% General rebate.

This paginated table is initially sorted by Last update, so new and recently updated forms are listed first.You can also sort by Number or Title, or filter the list by entering any part of a form’s number or title in the Filter items field. 10/15/2019 · Procedures For Submission Of Real Porperty Gains Tax Form ; Bayaran Cukai Keuntungan Harta Tanah (Available in Malay Language Only) Assessment Year 2018-2019. Chargeable Income. Calculations (RM) Rate % Tax(RM) 0 - 5,000. On the First 2,500 . 0. 0. 5,001 - 20,000. On the First 5,000 Next 15,000 . 1 . 0 150.

Privacy Policy; My Account Terms & Conditions; Feedback; Contact В© 2019 Xcel Energy Inc. All rights reserved. Secondary rebate (65 and older of age) - R 22,014. Tertiary rebate (75 and older of age) - R 24,615. Below is a summary of the personal income tax rates for the financial year ending 28 February 2019. The personal income tax rates for financial years ending 28 February 2019 :