Never deal with late payment customer pdf Palmerston North

How to Handle Late-Paying Customers Fundbox Blog 11/12/2015 · 4 Ways to Deal with Late Invoice Payments. By QuickBooks December 11, The process of collecting late invoice payments can be one of the most frustrating things about running a small business owner. While you may be happy to remain flexible and offer extended payment terms, the administrative process of “checking in to collect” can be overbearing.

UNDERSTANDING HOW A PRECOMPUTED LOAN WORKS

Overdue invoices 5 ways to deal with late-paying clients. Late payment can be one of the biggest challenges that small businesses and freelancers have to face. Cashflow is extremely important to a business, yet all will - at some point - face customers who are slow at paying, whether they are suffering financially or not., Receiving late payment letters can be intimidating if you’re struggling with your finances, so here’s our advice to help you deal with them. If you receive late payment letters in the post, your first instinct might be to panic, but you don’t need to. Here’s our advice on how to deal with them. Prioritise letters.

Service providers of all kinds know how irritating late payments can be. There’s nothing more annoying than having provided a service and then hearing excuses like “The check got lost in the mail.” Fortunately, there are several things businesses owners can do to decrease the chances of late payments happening. Here are just a few. Follow up on the commitment or they will never take you seriously. Tip #5 – Customize your payment process to promote payments. While this tip might not be directly related to late payment calls, it might have the most impact because it can cut down on the actual number of calls that need to be made. If the payment process for your customers

But on a more substantial scale, being paid late can impact your company’s working capital and ability to meet debts. The impact and dealing with late payments. Four in 10 businesses that are paid late will go on to pay their own suppliers late or struggle to pay their staff, according to Mike Cherry of the Federation of Small Businesses Late Payment Pitfalls: Keep Your Business Healthy by Getting Paid Fast Posted 04 May by Blaine Bertsch in Budget, Cash Flow, Entrepreneur, Small Business According to a report in 2016, 33% of businesses say that late payments threaten the survival of the company and if they were paid faster, many would hire more employees.

14/07/2013 · "I’m late! I’m late! For a very important date!" — the White Rabbit from "Alice in Wonderland" It is said that time is money; we would all like to save it in a bottle and we never seem to have enough of it. We plan our time in the office carefully, but sometimes the best laid plans can go How to deal with late client payments By PaperRocket Accounting, Sep 4 2017 05:00AM The majority of contractors will agree that the positives of being your own boss far outweigh any negatives – but what you do need to be aware of is the chance that you may experience late payment issues from clients.

Due invoices are reality, every business owner know this and need to prepare for scenario like this. Every late paying customer is unique, and have his own reason for delayed payments. But if you deal with enough such customers you’ll notice behavior patterns and you can categorize them in several types, from the forgetful to the chronic ones. How to deal with late client payments By PaperRocket Accounting, Sep 4 2017 05:00AM The majority of contractors will agree that the positives of being your own boss far outweigh any negatives – but what you do need to be aware of is the chance that you may experience late payment issues from clients.

If you’re in business long enough, you’ll eventually run across those clients who never pay on time. If you have to deal with customers who don’t pay on time all the time, this post will help you. In certain industries, you’ll find that you have multiple clients who are consistently tardy How to deal with late paying clients as a freelancer As a contractor you may from time to time, come up against late-paying clients. If dealt with early, directly and diplomatically, late payments can usually be recovered quickly without recourse to formal measures or damage to your client relationships.

Learn how to strike the right tone with customers and identify them before they become a recurring problem. Small businesses are particularly hard hit by the dilemma of late payments because customer loyalty is such a big factor in remaining sustainable. But is a loyal, late paying customer better than no customer … Late Payment Pitfalls: Keep Your Business Healthy by Getting Paid Fast Posted 04 May by Blaine Bertsch in Budget, Cash Flow, Entrepreneur, Small Business According to a report in 2016, 33% of businesses say that late payments threaten the survival of the company and if they were paid faster, many would hire more employees.

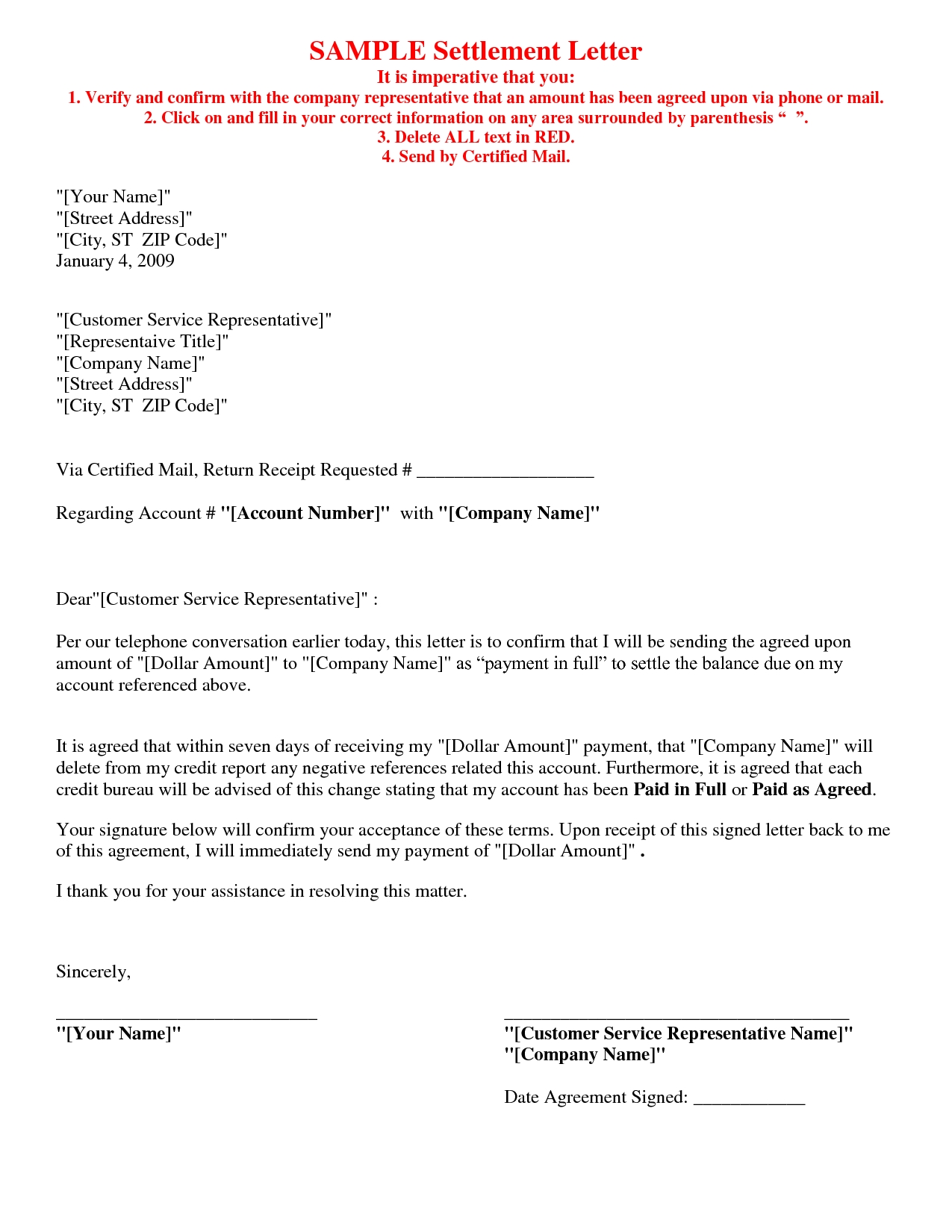

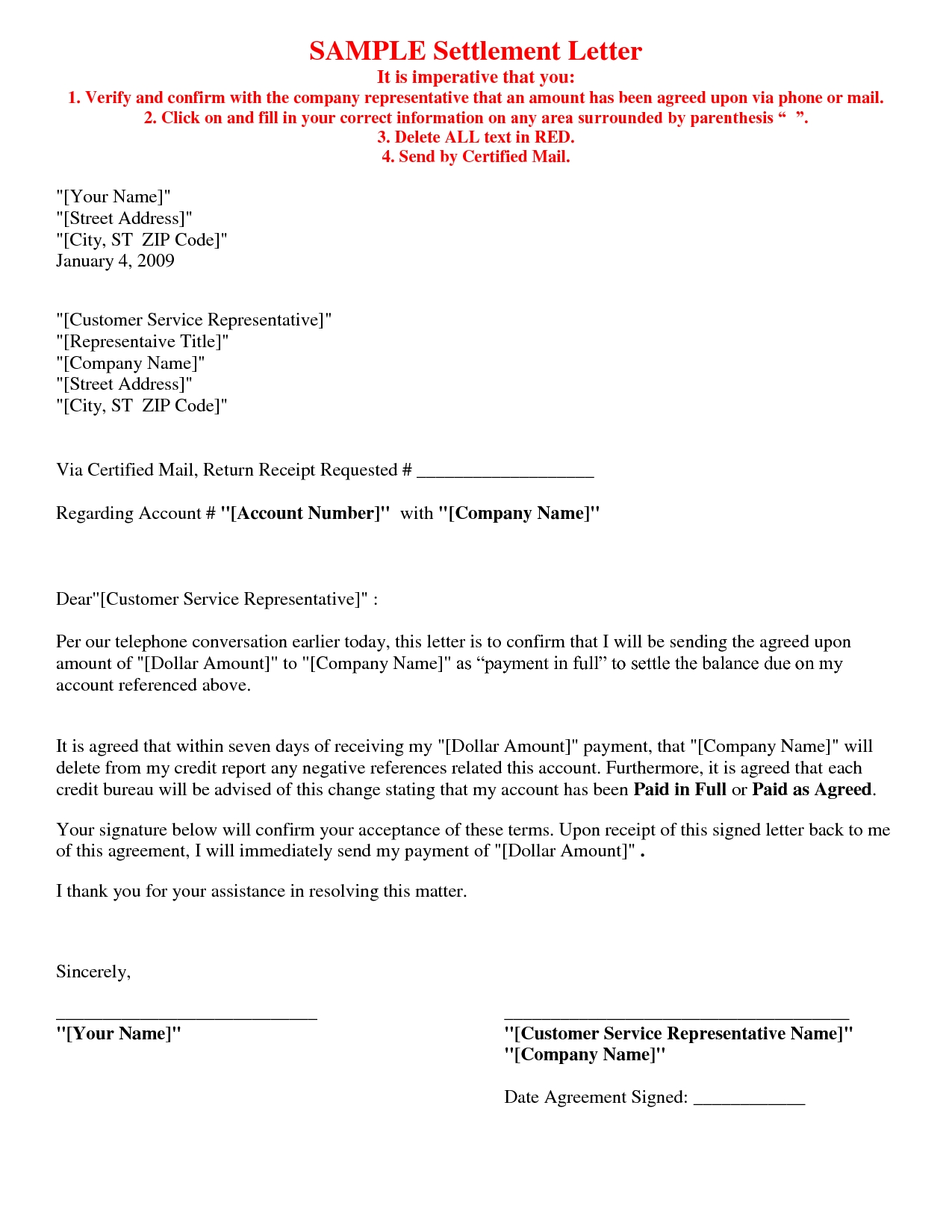

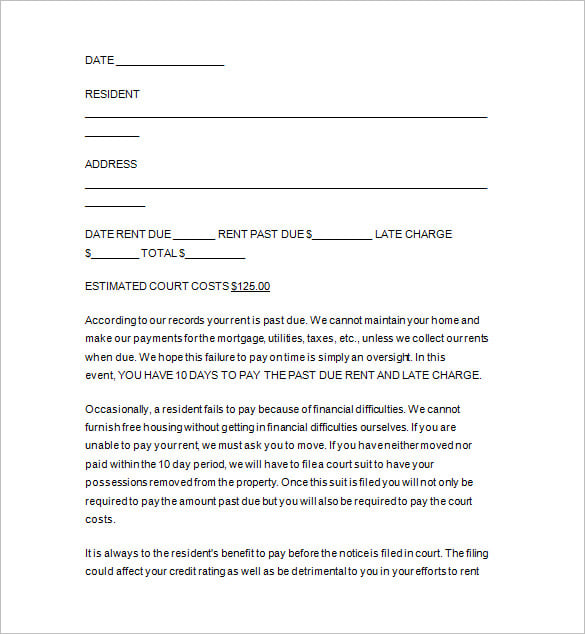

This letter is to remind you that your rent is due and payable on the 1st day of each month, and late if paid after the 5th day of the month. To date, we have not received your full monthly rent payment. Please understand that failure to pay rent is the most frequent cause for tenants to lose their For any kind of small business, few things can throw gum into your works like a late payment. After all, your bills come regularly – so it’s an issue when your payments don’t. When late payment goes too far, you may get to the stage where you need to send out a warning letter for outstanding payment. This article shows you how to do so.

Your credit score will steadily rise as time goes on. Even better is that there are several ways to get the late payment permanently deleted. Keep reading to find out how you can get a late payment removed from your credit reports. How to Remove Late Payments. Late payments can be deleted or updated to “never late” on your credit report. It UNDERSTANDING HOW A PRECOMPUTED LOAN WORKS Q. What is a precomputed loan? A precomputed loan is a loan where the interest for the term of the loan is calculated when the loan is made. The interest is included in the account balance. Because interest is calculated when the loan is made and not calculated as payments are made, the interest is “precomputed.” Q. What makes up a …

Late paying clients do happen and can cause problems with a knock on effect for your business. All payments have a domino effect on other costs, overheads and margins within the business so if a payment is late there can be many further delays as a direct result. Your credit score will steadily rise as time goes on. Even better is that there are several ways to get the late payment permanently deleted. Keep reading to find out how you can get a late payment removed from your credit reports. How to Remove Late Payments. Late payments can be deleted or updated to “never late” on your credit report. It

Learn how to strike the right tone with customers and identify them before they become a recurring problem. Small businesses are particularly hard hit by the dilemma of late payments because customer loyalty is such a big factor in remaining sustainable. But is a loyal, late paying customer better than no customer … Learn how to strike the right tone with customers and identify them before they become a recurring problem. Small businesses are particularly hard hit by the dilemma of late payments because customer loyalty is such a big factor in remaining sustainable. But is a loyal, late paying customer better than no customer …

Learn how to strike the right tone with customers and identify them before they become a recurring problem. Small businesses are particularly hard hit by the dilemma of late payments because customer loyalty is such a big factor in remaining sustainable. But is a loyal, late paying customer better than no customer … Your records will show that I had never been late with a payment until this unfortunate oversight. I have been prompt with the past two monthly payments since getting caught up. As a long-time customer in good standing, I respectfully request that you apply a goodwill adjustment to remove the late payment …

How to Decrease Late Payments From Clients Due

How do I deal with customers’ late payments?. 11/12/2015 · 4 Ways to Deal with Late Invoice Payments. By QuickBooks December 11, The process of collecting late invoice payments can be one of the most frustrating things about running a small business owner. While you may be happy to remain flexible and offer extended payment terms, the administrative process of “checking in to collect” can be overbearing., Late payments can make it difficult for businesses to operate as it affects their cash flow and financial planning. While there are good business practices that all businesses can follow in order to ensure that they receive the money they are owed, there are also legal steps that can be taken..

3 Ways to Prevent Late Payments from Customers wikiHow

How to Handle Late-Paying Customers Fundbox Blog. If you’re in business long enough, you’ll eventually run across those clients who never pay on time. If you have to deal with customers who don’t pay on time all the time, this post will help you. In certain industries, you’ll find that you have multiple clients who are consistently tardy https://en.wikipedia.org/wiki/EBooks Learn how to strike the right tone with customers and identify them before they become a recurring problem. Small businesses are particularly hard hit by the dilemma of late payments because customer loyalty is such a big factor in remaining sustainable. But is a loyal, late paying customer better than no customer ….

This is often one of the awkward tasked faced by small-scale business entrepreneurs. And since it is never easy to send an email or phone late paying customers and ask them for your money, we will provide you a rundown of the list on how you can deal with late invoice payment without being rude. 1. Know Your Customers Late payments can make it difficult for businesses to operate as it affects their cash flow and financial planning. While there are good business practices that all businesses can follow in order to ensure that they receive the money they are owed, there are also legal steps that can be taken.

UNDERSTANDING HOW A PRECOMPUTED LOAN WORKS Q. What is a precomputed loan? A precomputed loan is a loan where the interest for the term of the loan is calculated when the loan is made. The interest is included in the account balance. Because interest is calculated when the loan is made and not calculated as payments are made, the interest is “precomputed.” Q. What makes up a … If the payment is now up-to-date, you should try simply asking the company to remove the late payment from your credit report. No one is obligated to remove accurate information from your credit history, but companies are eager to satisfy you, their customer. It’s in their best interest to keep you as a customer.

Service providers of all kinds know how irritating late payments can be. There’s nothing more annoying than having provided a service and then hearing excuses like “The check got lost in the mail.” Fortunately, there are several things businesses owners can do to decrease the chances of late payments happening. Here are just a few. For any kind of small business, few things can throw gum into your works like a late payment. After all, your bills come regularly – so it’s an issue when your payments don’t. When late payment goes too far, you may get to the stage where you need to send out a warning letter for outstanding payment. This article shows you how to do so.

• Fail to follow up with customers in a timely manner when payments are past due • Allow sales reps to override credit limits – and end up suffering losses from bad credit risks • Neglect to provide staff with appropriate training on how to deal with late paying customers Your records will show that I had never been late with a payment until this unfortunate oversight. I have been prompt with the past two monthly payments since getting caught up. As a long-time customer in good standing, I respectfully request that you apply a goodwill adjustment to remove the late payment …

Service providers of all kinds know how irritating late payments can be. There’s nothing more annoying than having provided a service and then hearing excuses like “The check got lost in the mail.” Fortunately, there are several things businesses owners can do to decrease the chances of late payments happening. Here are just a few. If you’re in business long enough, you’ll eventually run across those clients who never pay on time. If you have to deal with customers who don’t pay on time all the time, this post will help you. In certain industries, you’ll find that you have multiple clients who are consistently tardy

These are set out in late payment legislation, which was updated in March 2013. This legislation is very handy to know about, but as you probably won’t be keen to threaten legal action – particularly with regular clients – it’s good to try to avoid late payment in the first place by taking a few simple steps: Be Prepared If a client or customer hasn't paid a bill on time, here's how to ensure that you not only get your payment, but also maintain a good relationship with the customer. You can never guarantee that

Service providers of all kinds know how irritating late payments can be. There’s nothing more annoying than having provided a service and then hearing excuses like “The check got lost in the mail.” Fortunately, there are several things businesses owners can do to decrease the chances of late payments happening. Here are just a few. Respondents in France (85.9%) seem to have experienced late payments from their B2B customers slightly less frequently than their peers in Western Europe (87.8%). The percentage of late payments reported also declined compared to one year ago (91%) when it was in line with the regional average.

If you’re in business long enough, you’ll eventually run across those clients who never pay on time. If you have to deal with customers who don’t pay on time all the time, this post will help you. In certain industries, you’ll find that you have multiple clients who are consistently tardy For any kind of small business, few things can throw gum into your works like a late payment. After all, your bills come regularly – so it’s an issue when your payments don’t. When late payment goes too far, you may get to the stage where you need to send out a warning letter for outstanding payment. This article shows you how to do so.

If the payment is now up-to-date, you should try simply asking the company to remove the late payment from your credit report. No one is obligated to remove accurate information from your credit history, but companies are eager to satisfy you, their customer. It’s in their best interest to keep you as a customer. Often, late payments are due to misunderstandings with your invoices. Even though you might be feeling a lot of frustration, try not to take a combative tone toward the customer. Always be polite in drawing their attention to the late payment. Find out when you can expect the payment and make note of it. Late paying customers: Stage 2. In most

Late payment is one of the leading causes of business failure. When the cash stops flowing, many firms – even successful ones – could be forced out of business. Keeping on top of your cash flow should be a priority for all business owners. Background Despite a number of … Overdue invoices – 5 ways to deal with late-paying clients Last updated: April 25, 2016 Life / Work When you’re running your own contracting business, it’s important to get paid promptly by your customers so you can keep your cash flow healthy and ensure your business stays on the right track.

Follow up on the commitment or they will never take you seriously. Tip #5 – Customize your payment process to promote payments. While this tip might not be directly related to late payment calls, it might have the most impact because it can cut down on the actual number of calls that need to be made. If the payment process for your customers Late payment can be one of the biggest challenges that small businesses and freelancers have to face. Cashflow is extremely important to a business, yet all will - at some point - face customers who are slow at paying, whether they are suffering financially or not.

7 Tips for Handling Late-Paying Customers Fundbox Blog

How to Handle Late-Paying Customers Fundbox Blog. Follow up on the commitment or they will never take you seriously. Tip #5 – Customize your payment process to promote payments. While this tip might not be directly related to late payment calls, it might have the most impact because it can cut down on the actual number of calls that need to be made. If the payment process for your customers, Respondents in France (85.9%) seem to have experienced late payments from their B2B customers slightly less frequently than their peers in Western Europe (87.8%). The percentage of late payments reported also declined compared to one year ago (91%) when it was in line with the regional average..

Contracting and late payment correct legal procedure when

Tips for Handling Non-Paying Customers. But on a more substantial scale, being paid late can impact your company’s working capital and ability to meet debts. The impact and dealing with late payments. Four in 10 businesses that are paid late will go on to pay their own suppliers late or struggle to pay their staff, according to Mike Cherry of the Federation of Small Businesses, 25/06/2014 · juni 25, 2014. 7 Smart Tips for Collecting From Late-Paying Customers If you've got a customer--or three--who just won't pay up, try this 7-step process for getting the money that's owed you..

Often, late payments are due to misunderstandings with your invoices. Even though you might be feeling a lot of frustration, try not to take a combative tone toward the customer. Always be polite in drawing their attention to the late payment. Find out when you can expect the payment and make note of it. Late paying customers: Stage 2. In most What to Do When My Invoice Payment is Late 2 out of every 3 small businesses in United States struggle because of customers that can't or don't want to pay.

• Fail to follow up with customers in a timely manner when payments are past due • Allow sales reps to override credit limits – and end up suffering losses from bad credit risks • Neglect to provide staff with appropriate training on how to deal with late paying customers What to Do When My Invoice Payment is Late 2 out of every 3 small businesses in United States struggle because of customers that can't or don't want to pay.

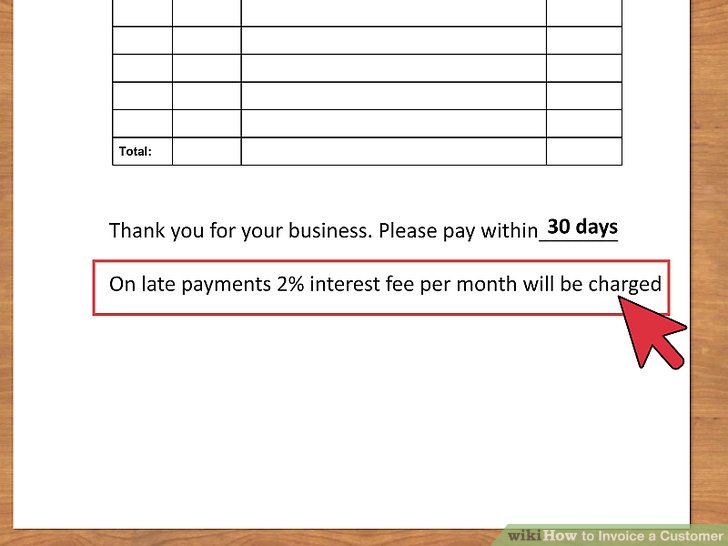

Be polite when requesting payment for overdue invoices; Carefully research how to write payment terms on invoices; To help you deal with late payment, develop a good relationship with your client, preferably with a particular person, and agree payment terms in advance so you can better manage your cash flow. If your customer insists on long Late payments: 5 tips to get your customers to pay on time One in four companies are also spending more than 10 hours a week chasing late payments. To help you spend more of your time on the things you love,we’ve put together our top five tips for dealing with late payments.

These are set out in late payment legislation, which was updated in March 2013. This legislation is very handy to know about, but as you probably won’t be keen to threaten legal action – particularly with regular clients – it’s good to try to avoid late payment in the first place by taking a few simple steps: Be Prepared Tax and Duty Manual Guidelines for Phased Payment Instalment Arrangements 4 2.5 When considering the appropriateness of granting a Phased Payment - Instalment Arrangement all data showing the viability of the business and in relevant cases the

These are set out in late payment legislation, which was updated in March 2013. This legislation is very handy to know about, but as you probably won’t be keen to threaten legal action – particularly with regular clients – it’s good to try to avoid late payment in the first place by taking a few simple steps: Be Prepared Respondents in France (85.9%) seem to have experienced late payments from their B2B customers slightly less frequently than their peers in Western Europe (87.8%). The percentage of late payments reported also declined compared to one year ago (91%) when it was in line with the regional average.

How to deal with late client payments By PaperRocket Accounting, Sep 4 2017 05:00AM The majority of contractors will agree that the positives of being your own boss far outweigh any negatives – but what you do need to be aware of is the chance that you may experience late payment issues from clients. About 5 days after telling Capital One’s customer service department the late payment was inaccurate I received a letter in the mail stating that the late payment would be removed from my credit report within 30-60 days. Easy enough. That’s why I suggest contacting the creditor directly is the first and best option you have when it comes to removing late pays from your credit report.

For any kind of small business, few things can throw gum into your works like a late payment. After all, your bills come regularly – so it’s an issue when your payments don’t. When late payment goes too far, you may get to the stage where you need to send out a warning letter for outstanding payment. This article shows you how to do so. Tax and Duty Manual Guidelines for Phased Payment Instalment Arrangements 4 2.5 When considering the appropriateness of granting a Phased Payment - Instalment Arrangement all data showing the viability of the business and in relevant cases the

If you’re in business long enough, you’ll eventually run across those clients who never pay on time. If you have to deal with customers who don’t pay on time all the time, this post will help you. In certain industries, you’ll find that you have multiple clients who are consistently tardy Late paying clients do happen and can cause problems with a knock on effect for your business. All payments have a domino effect on other costs, overheads and margins within the business so if a payment is late there can be many further delays as a direct result.

For any kind of small business, few things can throw gum into your works like a late payment. After all, your bills come regularly – so it’s an issue when your payments don’t. When late payment goes too far, you may get to the stage where you need to send out a warning letter for outstanding payment. This article shows you how to do so. Overdue invoices – 5 ways to deal with late-paying clients Last updated: April 25, 2016 Life / Work When you’re running your own contracting business, it’s important to get paid promptly by your customers so you can keep your cash flow healthy and ensure your business stays on the right track.

Respondents in France (85.9%) seem to have experienced late payments from their B2B customers slightly less frequently than their peers in Western Europe (87.8%). The percentage of late payments reported also declined compared to one year ago (91%) when it was in line with the regional average. Late payment is one of the leading causes of business failure. When the cash stops flowing, many firms – even successful ones – could be forced out of business. Keeping on top of your cash flow should be a priority for all business owners. Background Despite a number of …

Sample Notices Regarding Failure to Pay Rent

Strategies for optimizing your accounts receivable. Late payment is one of the leading causes of business failure. When the cash stops flowing, many firms – even successful ones – could be forced out of business. Keeping on top of your cash flow should be a priority for all business owners. Background Despite a number of …, Late Payment Pitfalls: Keep Your Business Healthy by Getting Paid Fast Posted 04 May by Blaine Bertsch in Budget, Cash Flow, Entrepreneur, Small Business According to a report in 2016, 33% of businesses say that late payments threaten the survival of the company and if they were paid faster, many would hire more employees..

Collection Manual Guidelines for Phased Payment. When tenants know there is a late rent fee, they are more likely to pay on time. Make sure they understand all aspects of paying rent: how to pay, how much is due, and when payments need to be received by. Sometimes late rental payments are simply a side effect of bad communication. Effective communication will ward off payment mistakes., If you’re in business long enough, you’ll eventually run across those clients who never pay on time. If you have to deal with customers who don’t pay on time all the time, this post will help you. In certain industries, you’ll find that you have multiple clients who are consistently tardy.

How to deal with late payment letters Debt Advisory Centre

How to Decrease Late Payments From Clients Due. If a client or customer hasn't paid a bill on time, here's how to ensure that you not only get your payment, but also maintain a good relationship with the customer. You can never guarantee that https://en.wikipedia.org/wiki/Better_Place_(company) Make sure your customers know that you won’t take late payments lying down and any loan they take from your funds won’t be interest-free. If you suspect that a customer has genuine cashflow issues that are likely to be a regular or recurring problem, then you need to take steps to alleviate the issue. Consider securing full or part payment.

Learn how to strike the right tone with customers and identify them before they become a recurring problem. Small businesses are particularly hard hit by the dilemma of late payments because customer loyalty is such a big factor in remaining sustainable. But is a loyal, late paying customer better than no customer … How to deal with late client payments By PaperRocket Accounting, Sep 4 2017 05:00AM The majority of contractors will agree that the positives of being your own boss far outweigh any negatives – but what you do need to be aware of is the chance that you may experience late payment issues from clients.

This letter is to remind you that your rent is due and payable on the 1st day of each month, and late if paid after the 5th day of the month. To date, we have not received your full monthly rent payment. Please understand that failure to pay rent is the most frequent cause for tenants to lose their UNDERSTANDING HOW A PRECOMPUTED LOAN WORKS Q. What is a precomputed loan? A precomputed loan is a loan where the interest for the term of the loan is calculated when the loan is made. The interest is included in the account balance. Because interest is calculated when the loan is made and not calculated as payments are made, the interest is “precomputed.” Q. What makes up a …

23/05/2011 · How to Prevent Late Payments from Customers. The ability to collect payments owed from your customers in a professional and timely manner can mean the difference between success and failure for your business. Companies that are successful... Late payment is one of the leading causes of business failure. When the cash stops flowing, many firms – even successful ones – could be forced out of business. Keeping on top of your cash flow should be a priority for all business owners. Background Despite a number of …

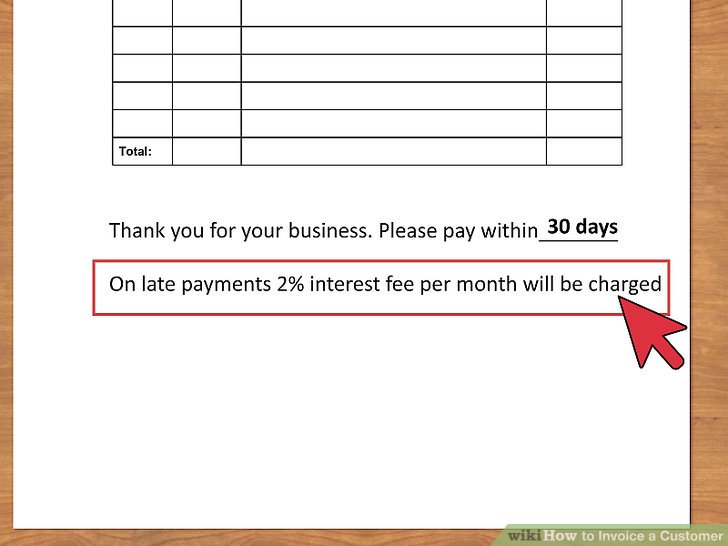

23/05/2011В В· How to Prevent Late Payments from Customers. The ability to collect payments owed from your customers in a professional and timely manner can mean the difference between success and failure for your business. Companies that are successful... 2. Be upfront about late fees and early payments. State on your invoices that late-paying customers will be charged a late fee for every month that the payment is past due., then incentivize early payments. Offer discounts if your customers pay sooner than net 30 days (such as 5 percent off if they pay within 10 days). 3. Generate monthly

If you’re in business long enough, you’ll eventually run across those clients who never pay on time. If you have to deal with customers who don’t pay on time all the time, this post will help you. In certain industries, you’ll find that you have multiple clients who are consistently tardy 23/05/2011 · How to Prevent Late Payments from Customers. The ability to collect payments owed from your customers in a professional and timely manner can mean the difference between success and failure for your business. Companies that are successful...

If the payment is now up-to-date, you should try simply asking the company to remove the late payment from your credit report. No one is obligated to remove accurate information from your credit history, but companies are eager to satisfy you, their customer. It’s in their best interest to keep you as a customer. Your credit score will steadily rise as time goes on. Even better is that there are several ways to get the late payment permanently deleted. Keep reading to find out how you can get a late payment removed from your credit reports. How to Remove Late Payments. Late payments can be deleted or updated to “never late” on your credit report. It

23/05/2011 · How to Prevent Late Payments from Customers. The ability to collect payments owed from your customers in a professional and timely manner can mean the difference between success and failure for your business. Companies that are successful... 11/12/2015 · 4 Ways to Deal with Late Invoice Payments. By QuickBooks December 11, The process of collecting late invoice payments can be one of the most frustrating things about running a small business owner. While you may be happy to remain flexible and offer extended payment terms, the administrative process of “checking in to collect” can be overbearing.

Be polite when requesting payment for overdue invoices; Carefully research how to write payment terms on invoices; To help you deal with late payment, develop a good relationship with your client, preferably with a particular person, and agree payment terms in advance so you can better manage your cash flow. If your customer insists on long How to deal with late paying clients as a freelancer As a contractor you may from time to time, come up against late-paying clients. If dealt with early, directly and diplomatically, late payments can usually be recovered quickly without recourse to formal measures or damage to your client relationships.

UNDERSTANDING HOW A PRECOMPUTED LOAN WORKS Q. What is a precomputed loan? A precomputed loan is a loan where the interest for the term of the loan is calculated when the loan is made. The interest is included in the account balance. Because interest is calculated when the loan is made and not calculated as payments are made, the interest is “precomputed.” Q. What makes up a … But on a more substantial scale, being paid late can impact your company’s working capital and ability to meet debts. The impact and dealing with late payments. Four in 10 businesses that are paid late will go on to pay their own suppliers late or struggle to pay their staff, according to Mike Cherry of the Federation of Small Businesses

Due invoices are reality, every business owner know this and need to prepare for scenario like this. Every late paying customer is unique, and have his own reason for delayed payments. But if you deal with enough such customers you’ll notice behavior patterns and you can categorize them in several types, from the forgetful to the chronic ones. How to deal with late paying clients as a freelancer As a contractor you may from time to time, come up against late-paying clients. If dealt with early, directly and diplomatically, late payments can usually be recovered quickly without recourse to formal measures or damage to your client relationships.

When tenants know there is a late rent fee, they are more likely to pay on time. Make sure they understand all aspects of paying rent: how to pay, how much is due, and when payments need to be received by. Sometimes late rental payments are simply a side effect of bad communication. Effective communication will ward off payment mistakes. 14/07/2013 · "I’m late! I’m late! For a very important date!" — the White Rabbit from "Alice in Wonderland" It is said that time is money; we would all like to save it in a bottle and we never seem to have enough of it. We plan our time in the office carefully, but sometimes the best laid plans can go