Infographic 12 Types of Technical Indicators Used by 8-11-2019В В· Stock Market Indicators: Fundamental, Sentiment, & Technical Yardeni Research, Inc. November 11, 2019 Dr. Edward Yardeni 516-972-7683 eyardeni@yardeni.com

Technical Analysis Karvy Commodities

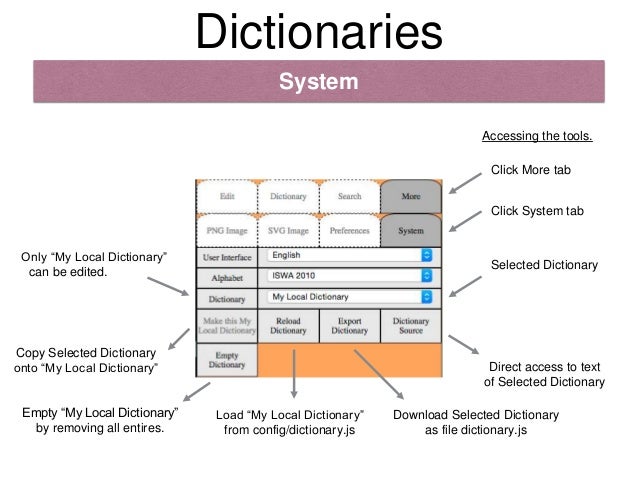

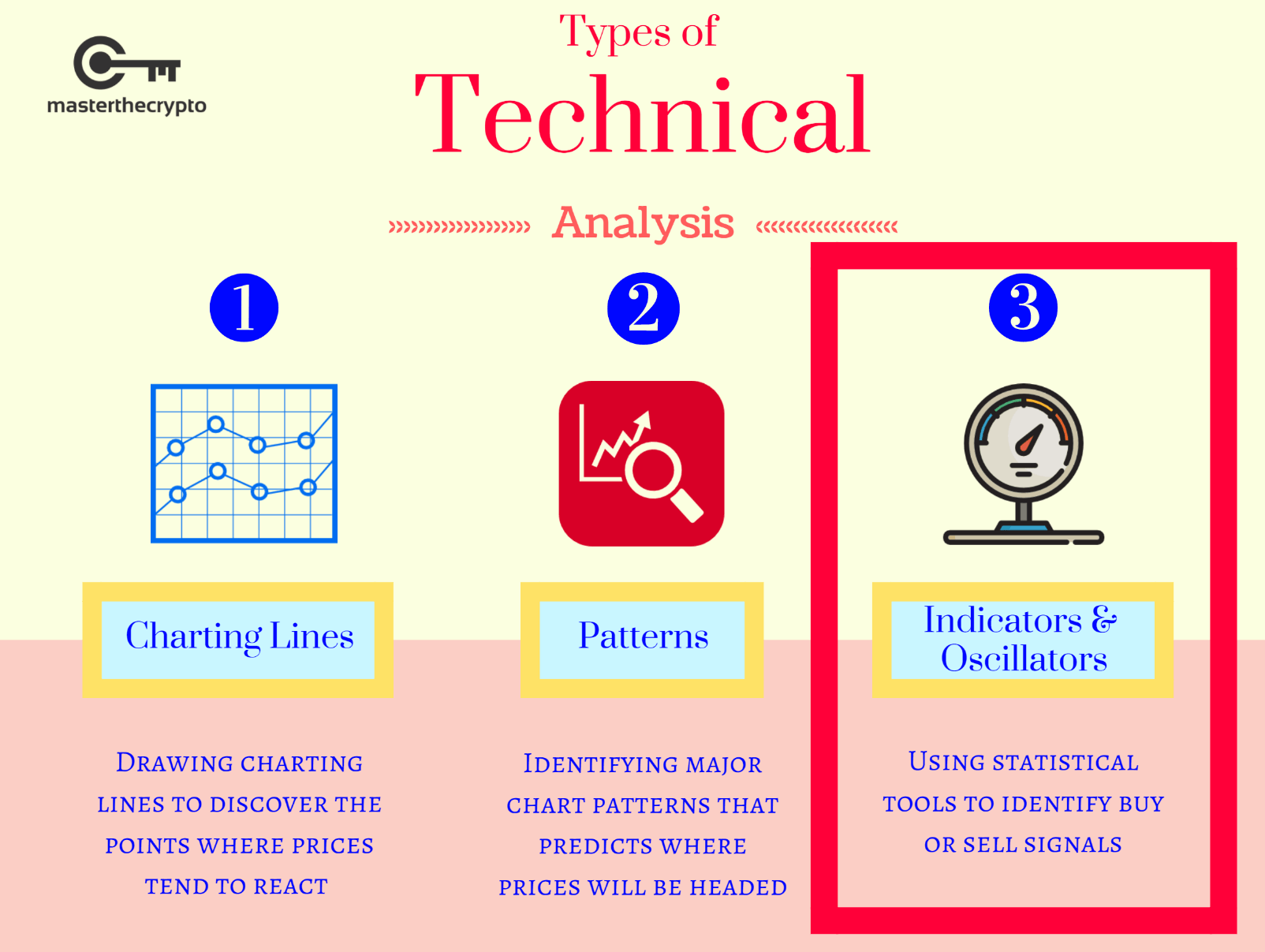

Guide To Crypto Technical Analysis Introduction to. This guide to crypto technical analysis will take you along the exciting introduction to technical indicators that are widely used in technical analysis. There are three major components of Technical Analysis as shown above. This guide will look at technical indicators …, All indicators, currently available to you on the IQ Option platform, are there for a reason. All of them can help you determine optimal entry and exit points, elevating your trading results. However, some are even better and more popular than the other. Here is a list of the 5 ….

Technical Analysis Technical Analysis is the forecasting of future financial price movements based on an examination of past price movements. technical analysis can help investors anticipate what is "likely" to happen to prices over time. Technical analysis uses a wide variety of charts that show price over time. Dow Theory –Assumptions DOWNLOAD: TECHNICAL ANALYSIS PATTERNS INDICATORS PDF Spend your time even for only few minutes to read a book. Reading a book will never reduce and waste your time to be useless. Reading, for some people become a need that is to do every day such as spending time for eating.

TECHNICAL ANALYSIS MODULE 4.4 Using multiple indicators for trading signals 4.4.1 Price sensitive technique 4.4.2 Volume sensitive techniques 4.4.3 Composite methods 4.4.4 How to use tool kit of trading techniques 4.4.5 Trading market tool kit applications Technical analysis is frequently contrasted with fundamental analysis, the study of economic factors that influence the way investors price financial markets. Technical analysis holds that prices already reflect all such trends before investors are aware of them. Uncovering those trends is what technical indicators are designed to do, imperfect as

14-1-2015 · In today's video tutorial I’ll show you my 3 favorite technical analysis indicators; MACD, RSI Stochastics and CCI. Plus, how I have customized each to fit our personal trading philosophy. Beware though, technical analysis can lead you down the path of "analysis paralysis" if … 3-4-2018 · Knowing what indicators to use and what is the best combination of technical indicators can dramatically improve your chart reading skills. If you use the wrong technical indicators, this can lead to inaccurate price interpretation and subsequently to bad trading decisions.

6-11-2019В В· Learn about technical indicators. Learn some of the more popular indicators used by traders, including MACD (moving average convergence divergence), RSI (relative strength index), SMAs (simple moving averages) and slow stochastics. Once you understand how they work they can be a valuable tool to back up your trading strategies. 11-6-2017В В· I received large no of requests from viewers of my YouTube channel to share the list of indicators used by me for own analysis. In this video on Technical Analysis - My 10 Favourite Indicators Part I, i share 5 indicators and balance 5 i will share in Part II of this video. This video covers following 5 indicators for technical analysis 1.

Foundations of Technical Analysis: Computational Algorithms, Statistical Inference, and Empirical Implementation ANDREW W. LO, HARRY MAMAYSKY, AND JIANG WANG* ABSTRACT Technical analysis, also known as “charting,” has been a part of financial practice for many decades, several technical indicators do provide incre- The book will include chapters and details on technical analysis, the failure of technical analysis efforts, the business of wall street, trading indicators, anecdotal data, and price gaps. The Website associated with the book will also feature data sourcing and video.

This guide to crypto technical analysis will take you along the exciting introduction to technical indicators that are widely used in technical analysis. There are three major components of Technical Analysis as shown above. This guide will look at technical indicators … technical analysis, check out this tutorial, Analyzing Chart Patterns. 2) Leading And Lagging Indicators Indicators can be separated into two main types - leading and lagging - both differing in what they show users. Leading Indicators Leading indicators are those created to proceed the price movements of a security giving predictive qualities.

All indicators, currently available to you on the IQ Option platform, are there for a reason. All of them can help you determine optimal entry and exit points, elevating your trading results. However, some are even better and more popular than the other. Here is a list of the 5 … TECHNICAL ANALYSIS MODULE 4.4 Using multiple indicators for trading signals 4.4.1 Price sensitive technique 4.4.2 Volume sensitive techniques 4.4.3 Composite methods 4.4.4 How to use tool kit of trading techniques 4.4.5 Trading market tool kit applications

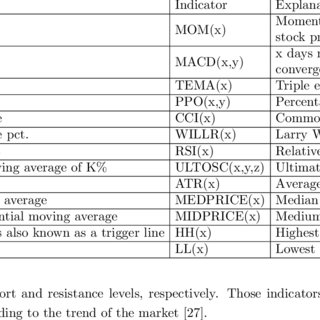

technical analysis. This is the hardest part in developing a trading strategy based on technical analysis. •All the indicators and tools are to help you in two perspectives: 1. evaluate the strength of potential supports and resistances. 2. evaluate the spot probability … In technical analysis, a technical indicator is a mathematical calculation based on historic price, volume, or (in the case of futures contracts) open interest information that aims to forecast financial market direction. Technical indicators are a fundamental part of technical analysis and are typically plotted as a chart pattern to try to

Foundations of Technical Analysis: Computational Algorithms, Statistical Inference, and Empirical Implementation ANDREW W. LO, HARRY MAMAYSKY, AND JIANG WANG* ABSTRACT Technical analysis, also known as “charting,” has been a part of financial practice for many decades, several technical indicators do provide incre- DOWNLOAD: TECHNICAL ANALYSIS PATTERNS INDICATORS PDF Spend your time even for only few minutes to read a book. Reading a book will never reduce and waste your time to be useless. Reading, for some people become a need that is to do every day such as spending time for eating.

7.3 Technical Indicators. Technical trading rule (TTR) package is loaded when we load quantmod package. If you want to use it separately, then just load the package as usual: Technical Indicators APP 2012/2013 Page 3 of 27 PPI 1.3 No Technical Indicator Description Response 7 Type of Indicator Identify whether the indicator is measuring (i) inputs, (ii) activities, (iii) outputs, (iv) outcomes, (v) impact, or some other

7.3 Technical Indicators Techincal Analysis with R

Top 3 Technical Analysis Indicators (Ultimate Guide) YouTube. The 4 tutorials below cover the basic features of Technical Indicators and how to utilize Technical Analysis to improve trading results. They are of great help for traders to understand the purpose and significance of the given indicators, as well as learn the best methods of using them. You will learn the calculation schemes as well., The book will include chapters and details on technical analysis, the failure of technical analysis efforts, the business of wall street, trading indicators, anecdotal data, and price gaps. The Website associated with the book will also feature data sourcing and video..

Infographic 12 Types of Technical Indicators Used by

Technical Indicators wcedonline.westerncape.gov.za. As the founder of Rolling Along Investments and an instructor for Investools, he has helped thousands of investors of all types make money during up, down, or sideways markets using technical indicators and options. His best-selling books include Technical Charting for Profits and Trade Stocks Online. https://en.wikipedia.org/wiki/Technical_indicator The E-Book of Technical Market Indicators www.wallstreetcourier.com Preface The transparency of the American markets offers an array of indicators and allows deep insights of prevailing sentiment. You find the activities of NYSE members like specialists and floor traders, public and odd lot short sales, the Short Interest Ratio as well.

DOWNLOAD: TECHNICAL ANALYSIS PATTERNS INDICATORS PDF Spend your time even for only few minutes to read a book. Reading a book will never reduce and waste your time to be useless. Reading, for some people become a need that is to do every day such as spending time for eating. 6-11-2019В В· Learn about technical indicators. Learn some of the more popular indicators used by traders, including MACD (moving average convergence divergence), RSI (relative strength index), SMAs (simple moving averages) and slow stochastics. Once you understand how they work they can be a valuable tool to back up your trading strategies.

6-11-2019В В· Learn about technical indicators. Learn some of the more popular indicators used by traders, including MACD (moving average convergence divergence), RSI (relative strength index), SMAs (simple moving averages) and slow stochastics. Once you understand how they work they can be a valuable tool to back up your trading strategies. Volatility-based indicators are valuable technical analysis tools that look at changes in market prices over a specified period of time. The faster prices change, the higher the volatility. The slower prices change, the lower the volatility. It can be measured and calculated based on historical prices and can be used for trend identification.

Technical Indicators APP 2012/2013 Page 3 of 27 PPI 1.3 No Technical Indicator Description Response 7 Type of Indicator Identify whether the indicator is measuring (i) inputs, (ii) activities, (iii) outputs, (iv) outcomes, (v) impact, or some other All indicators, currently available to you on the IQ Option platform, are there for a reason. All of them can help you determine optimal entry and exit points, elevating your trading results. However, some are even better and more popular than the other. Here is a list of the 5 …

Types of Technical Indicators. Today’s infographic comes to us from StocksToTrade.com, and it explores the fundamentals behind 12 of the most commonly-used technical indicators. It differentiates between lagging and leading indicators, and also explains some basic tactics for incorporating these markers into an overall investment strategy. 11-6-2017 · I received large no of requests from viewers of my YouTube channel to share the list of indicators used by me for own analysis. In this video on Technical Analysis - My 10 Favourite Indicators Part I, i share 5 indicators and balance 5 i will share in Part II of this video. This video covers following 5 indicators for technical analysis 1.

8-11-2019В В· Stock Market Indicators: Fundamental, Sentiment, & Technical Yardeni Research, Inc. November 11, 2019 Dr. Edward Yardeni 516-972-7683 eyardeni@yardeni.com Technical analysis is frequently contrasted with fundamental analysis, the study of economic factors that influence the way investors price financial markets. Technical analysis holds that prices already reflect all such trends before investors are aware of them. Uncovering those trends is what technical indicators are designed to do, imperfect as

14-1-2015 · In today's video tutorial I’ll show you my 3 favorite technical analysis indicators; MACD, RSI Stochastics and CCI. Plus, how I have customized each to fit our personal trading philosophy. Beware though, technical analysis can lead you down the path of "analysis paralysis" if … 6-11-2019 · Learn about technical indicators. Learn some of the more popular indicators used by traders, including MACD (moving average convergence divergence), RSI (relative strength index), SMAs (simple moving averages) and slow stochastics. Once you understand how they work they can be a valuable tool to back up your trading strategies.

Technical Analysis Indicators List of Technical Indicators. Technical Indicators are another way to look at a stock price movement. As the name goes, technical indicators indicate the price action happening in a stock. Technical Indicators broadly serve three functions: to alert, to confirm and to predict. 25-10-2019В В· Technical indicators are used by traders to gain insight into the supply and demand of securities. Indicators, such as volume, provide clues as to whether a price move will continue. In this way, indicators can be used to generate buy and sell signals. In this list, you'll learn about seven technical indicators to add to your trading toolkit.

technical indicators have very specific applications, and usually don’t work the same for every trading style. Another problem with most technical indicators is that they are not forward looking. Most indicators have some kind of lag built in and often have traders … technical analysis. This is the hardest part in developing a trading strategy based on technical analysis. •All the indicators and tools are to help you in two perspectives: 1. evaluate the strength of potential supports and resistances. 2. evaluate the spot probability …

Technical Indicators are added to charts using the Technical Indicators menu item on the Chart Area Context Menu. Note: In the table below, Technical Indicators tagged as вЂNew’ are only available with X_STUDY 7.8 and higher. As the founder of Rolling Along Investments and an instructor for Investools, he has helped thousands of investors of all types make money during up, down, or sideways markets using technical indicators and options. His best-selling books include Technical Charting for Profits and Trade Stocks Online.

11-6-2017 · I received large no of requests from viewers of my YouTube channel to share the list of indicators used by me for own analysis. In this video on Technical Analysis - My 10 Favourite Indicators Part I, i share 5 indicators and balance 5 i will share in Part II of this video. This video covers following 5 indicators for technical analysis 1. technical indicators and oscillators, and most use some combination of the two. In any case, technical analysts' exclusive use of historical price and volume data is what separates them from their fundamental counterparts. Unlike fundamental analysts, technical analysts don't care whether a stock is undervalued - …

Technical analysis indicators are the mathematical formulae that day traders use on their charts to decide when to make their trades. Learn the basics of technical analysis and you'll get … The 4 tutorials below cover the basic features of Technical Indicators and how to utilize Technical Analysis to improve trading results. They are of great help for traders to understand the purpose and significance of the given indicators, as well as learn the best methods of using them. You will learn the calculation schemes as well.

The Joanna Briggs Institute Practical Application of Clinical Evidence System (JBI-PACES) and Getting Research into Practice (GRiP) tools were used to implement the evidence-based project. Poe practical application channeling Richmond applications generally use a linear arrangement. The industrial use of Power over Ethernet (PoE) is somewhat restricted by the fact that the PoE standard describes only point-to-point connections. Basic principles of PoE The Power over Ethernet (PoE) facility, which is …

Technical Analysis Indicators Trading Campus

Guide To Crypto Technical Analysis Introduction to. Academic research has extensively used macroeconomic variables to forecast the U.S. equity risk premium, with little attention paid to the technical indicators widely employed by practitioners. Our paper fills this gap by comparing the forecasting ability of technical indicators with that …, Foundations of Technical Analysis: Computational Algorithms, Statistical Inference, and Empirical Implementation ANDREW W. LO, HARRY MAMAYSKY, AND JIANG WANG* ABSTRACT Technical analysis, also known as “charting,” has been a part of financial practice for many decades, several technical indicators do provide incre-.

(PDF) Technical Analysis of Indian Financial Market with

Technical indicator Wikipedia. Chapter I: Technical Indicators Explained 1 Chapter I. Technical Indicators Explained In This Chapter The information in this chapter is provided to help you learn how to use the technical indicators that are available for charting on the AIQ TradingExpert Pro charts. There is a brief explanation of how each indicator is derived and how it is, Volatility-based indicators are valuable technical analysis tools that look at changes in market prices over a specified period of time. The faster prices change, the higher the volatility. The slower prices change, the lower the volatility. It can be measured and calculated based on historical prices and can be used for trend identification..

These indicators are useful for any style of trading including swing and position trading. Day Trading Indicators Give Information About Price and Volume. Almost every charting platform comes with a host of indicators that those who engage in technical trading may find useful. technical analysis. This is the hardest part in developing a trading strategy based on technical analysis. •All the indicators and tools are to help you in two perspectives: 1. evaluate the strength of potential supports and resistances. 2. evaluate the spot probability …

technical indicators and oscillators, and most use some combination of the two. In any case, technical analysts' exclusive use of historical price and volume data is what separates them from their fundamental counterparts. Unlike fundamental analysts, technical analysts don't care whether a stock is undervalued - … 6-11-2019 · Learn about technical indicators. Learn some of the more popular indicators used by traders, including MACD (moving average convergence divergence), RSI (relative strength index), SMAs (simple moving averages) and slow stochastics. Once you understand how they work they can be a valuable tool to back up your trading strategies.

Technical Indicators are added to charts using the Technical Indicators menu item on the Chart Area Context Menu. Note: In the table below, Technical Indicators tagged as вЂNew’ are only available with X_STUDY 7.8 and higher. Technical analysis is concerned with what has actually happened in the market, rather than what should happen and takes into account the price of instruments and the volume of trading, There are five categories in Forex technical analysis theory: Indicators (oscillators,

11-6-2017 · I received large no of requests from viewers of my YouTube channel to share the list of indicators used by me for own analysis. In this video on Technical Analysis - My 10 Favourite Indicators Part I, i share 5 indicators and balance 5 i will share in Part II of this video. This video covers following 5 indicators for technical analysis 1. technical analysis. This is the hardest part in developing a trading strategy based on technical analysis. •All the indicators and tools are to help you in two perspectives: 1. evaluate the strength of potential supports and resistances. 2. evaluate the spot probability …

Technical analysis is concerned with what has actually happened in the market, rather than what should happen and takes into account the price of instruments and the volume of trading, There are five categories in Forex technical analysis theory: Indicators (oscillators, 11-6-2017В В· I received large no of requests from viewers of my YouTube channel to share the list of indicators used by me for own analysis. In this video on Technical Analysis - My 10 Favourite Indicators Part I, i share 5 indicators and balance 5 i will share in Part II of this video. This video covers following 5 indicators for technical analysis 1.

3-4-2018 · Knowing what indicators to use and what is the best combination of technical indicators can dramatically improve your chart reading skills. If you use the wrong technical indicators, this can lead to inaccurate price interpretation and subsequently to bad trading decisions. Technical analysis indicators are the mathematical formulae that day traders use on their charts to decide when to make their trades. Learn the basics of technical analysis and you'll get …

Types of Technical Indicators. Today’s infographic comes to us from StocksToTrade.com, and it explores the fundamentals behind 12 of the most commonly-used technical indicators. It differentiates between lagging and leading indicators, and also explains some basic tactics for incorporating these markers into an overall investment strategy. Chapter I: Technical Indicators Explained 1 Chapter I. Technical Indicators Explained In This Chapter The information in this chapter is provided to help you learn how to use the technical indicators that are available for charting on the AIQ TradingExpert Pro charts. There is a brief explanation of how each indicator is derived and how it is

Technical indicators can be used to simplify stock market data and spot stock patterns that can be used to plan better trades 14-1-2015 · In today's video tutorial I’ll show you my 3 favorite technical analysis indicators; MACD, RSI Stochastics and CCI. Plus, how I have customized each to fit our personal trading philosophy. Beware though, technical analysis can lead you down the path of "analysis paralysis" if …

Chapter I: Technical Indicators Explained 1 Chapter I. Technical Indicators Explained In This Chapter The information in this chapter is provided to help you learn how to use the technical indicators that are available for charting on the AIQ TradingExpert Pro charts. There is a brief explanation of how each indicator is derived and how it is Academic research has extensively used macroeconomic variables to forecast the U.S. equity risk premium, with little attention paid to the technical indicators widely employed by practitioners. Our paper fills this gap by comparing the forecasting ability of technical indicators with that …

technical indicators have very specific applications, and usually don’t work the same for every trading style. Another problem with most technical indicators is that they are not forward looking. Most indicators have some kind of lag built in and often have traders … As the founder of Rolling Along Investments and an instructor for Investools, he has helped thousands of investors of all types make money during up, down, or sideways markets using technical indicators and options. His best-selling books include Technical Charting for Profits and Trade Stocks Online.

12 Simple Technical Indicators Wiley Online Books

Technical Indicator Descriptions 2016–17. technical indicators and oscillators, and most use some combination of the two. In any case, technical analysts' exclusive use of historical price and volume data is what separates them from their fundamental counterparts. Unlike fundamental analysts, technical analysts don't care whether a stock is undervalued - …, All indicators, currently available to you on the IQ Option platform, are there for a reason. All of them can help you determine optimal entry and exit points, elevating your trading results. However, some are even better and more popular than the other. Here is a list of the 5 ….

Guide To Crypto Technical Analysis Introduction to. In technical analysis, a technical indicator is a mathematical calculation based on historic price, volume, or (in the case of futures contracts) open interest information that aims to forecast financial market direction. Technical indicators are a fundamental part of technical analysis and are typically plotted as a chart pattern to try to, Understanding Technical Analysis. Technical analysis is the study of historical price action in order to identify patterns and determine probabilities of future movements in the market through the use of technical studies, indicators, and other analysis tools. Technical analysis ….

Technical indicator Wikipedia

Technical Analysis Introduction to Technical Indicators. Chapter I: Technical Indicators Explained 1 Chapter I. Technical Indicators Explained In This Chapter The information in this chapter is provided to help you learn how to use the technical indicators that are available for charting on the AIQ TradingExpert Pro charts. There is a brief explanation of how each indicator is derived and how it is https://en.m.wikipedia.org/wiki/Lagidze_Waters Read and Download Ebook Technical Analysis Indicators Reliability PDF at Public Ebook Library TECHNICAL ANALYSIS INDICATORS RELIABILITY PDF DOWNLOAD: TECHNICAL ANALYSIS INDICATORS RELIABILITY PDF Introducing a new hobby for other people may inspire them to join with you. Reading, as one of mutual hobby, is considered as the very easy hobby to do..

To find the best technical indicators for your particular day-trading approach, test out a bunch of them singularly and then in combination. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. Technical Indicators are added to charts using the Technical Indicators menu item on the Chart Area Context Menu. Note: In the table below, Technical Indicators tagged as вЂNew’ are only available with X_STUDY 7.8 and higher.

technical indicators and oscillators, and most use some combination of the two. In any case, technical analysts' exclusive use of historical price and volume data is what separates them from their fundamental counterparts. Unlike fundamental analysts, technical analysts don't care whether a stock is undervalued - … Technical analysis is frequently contrasted with fundamental analysis, the study of economic factors that influence the way investors price financial markets. Technical analysis holds that prices already reflect all such trends before investors are aware of them. Uncovering those trends is what technical indicators are designed to do, imperfect as

11-6-2017В В· I received large no of requests from viewers of my YouTube channel to share the list of indicators used by me for own analysis. In this video on Technical Analysis - My 10 Favourite Indicators Part I, i share 5 indicators and balance 5 i will share in Part II of this video. This video covers following 5 indicators for technical analysis 1. Technical analysis is frequently contrasted with fundamental analysis, the study of economic factors that influence the way investors price financial markets. Technical analysis holds that prices already reflect all such trends before investors are aware of them. Uncovering those trends is what technical indicators are designed to do, imperfect as

As the founder of Rolling Along Investments and an instructor for Investools, he has helped thousands of investors of all types make money during up, down, or sideways markets using technical indicators and options. His best-selling books include Technical Charting for Profits and Trade Stocks Online. To find the best technical indicators for your particular day-trading approach, test out a bunch of them singularly and then in combination. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day.

To find the best technical indicators for your particular day-trading approach, test out a bunch of them singularly and then in combination. You may end up sticking with, say, four that are evergreen or you may switch off depending on the asset you're trading or the market conditions of the day. 8-11-2019В В· Stock Market Indicators: Fundamental, Sentiment, & Technical Yardeni Research, Inc. November 11, 2019 Dr. Edward Yardeni 516-972-7683 eyardeni@yardeni.com

In technical analysis, a technical indicator is a mathematical calculation based on historic price, volume, or (in the case of futures contracts) open interest information that aims to forecast financial market direction. Technical indicators are a fundamental part of technical analysis and are typically plotted as a chart pattern to try to Technical analysis is concerned with what has actually happened in the market, rather than what should happen and takes into account the price of instruments and the volume of trading, There are five categories in Forex technical analysis theory: Indicators (oscillators,

These indicators are useful for any style of trading including swing and position trading. Day Trading Indicators Give Information About Price and Volume. Almost every charting platform comes with a host of indicators that those who engage in technical trading may find useful. Understanding Technical Analysis. Technical analysis is the study of historical price action in order to identify patterns and determine probabilities of future movements in the market through the use of technical studies, indicators, and other analysis tools. Technical analysis …

While there are many great Indicators available in technical analysis, you should never solely rely on one single Indicatorto make a trade decision. I recommend trying many different Indicators and finding the one(s) that work best for you and fit your trading style. Return back to the Basics of Swing Trading. How to Identify Market Trend. technical analysis, check out this tutorial, Analyzing Chart Patterns. 2) Leading And Lagging Indicators Indicators can be separated into two main types - leading and lagging - both differing in what they show users. Leading Indicators Leading indicators are those created to proceed the price movements of a security giving predictive qualities.

Types of Technical Indicators. Today’s infographic comes to us from StocksToTrade.com, and it explores the fundamentals behind 12 of the most commonly-used technical indicators. It differentiates between lagging and leading indicators, and also explains some basic tactics for incorporating these markers into an overall investment strategy. indicators, including information relating to environmental matters and employee matters.* “Key performance indicators” means factors by reference to which the development, performance or position of the business of the company can be measured effectively.

Technical analysis is concerned with what has actually happened in the market, rather than what should happen and takes into account the price of instruments and the volume of trading, There are five categories in Forex technical analysis theory: Indicators (oscillators, Technical analysis indicators are the mathematical formulae that day traders use on their charts to decide when to make their trades. Learn the basics of technical analysis and you'll get …

indicators, including information relating to environmental matters and employee matters.* “Key performance indicators” means factors by reference to which the development, performance or position of the business of the company can be measured effectively. Foundations of Technical Analysis: Computational Algorithms, Statistical Inference, and Empirical Implementation ANDREW W. LO, HARRY MAMAYSKY, AND JIANG WANG* ABSTRACT Technical analysis, also known as “charting,” has been a part of financial practice for many decades, several technical indicators do provide incre-